Connect Us

Connect Us

Mar 05, 2024

Mar 05, 2024

Innovation, development, social security, peace, and climate mitigation need enormous amounts of funding. Let us look at some current trends, challenges, and ethical benchmarks for solutions. The private sector plays a key role in it. Let us look in this short article at current volatility, ethical benchmarks, spiritual roots, and integrated solutions.

Threatening volatility

The volatility of international financial markets is increasing. The debt on all levels, from companies, private households, and institutions up to governments and multilateral institutions, is a lot. The number of corporate insolvencies is swiftly increasing. In 2023, France was expected to have the highest number of companies in insolvency, i.e., 60,000 companies. India, in view of its large size, has a relatively lower insolvency rate, with a public estimate of 1650 bankruptcies. However, more and more cities, municipalities, and states are declaring insolvency. While 50 percent of the world's poorest countries need urgent debt relief, corruption is not decreasing. Even with efforts, legislation, and standards since over thirty years in the question of lead currencies, the dollar is experiencing a decrease in global financial transactions as other currencies, especially those from the BRICS+5 countries, want to build a counterweight. Taxing speculative transactions is in discussion again, as in past decades with the so called Tobin tax. However, we are far from an international agreement for such a tax, and countries still depend mainly on corporate and income tax from workers.

India has a long tradition of combining business and religious ethical values. Ethical values cannot simply be taught in business school, and management training.

However, on the positive side, multilateral UN agreements on climate mitigation and carbon neutral economies have resulted in substantial efforts towards green investments, CO2 compensation mechanisms, impact investing, and sustainable investing. But it is still far from being enough to reach carbon neutrality in time, as many green investment projects are criticized for greenwashing.

A huge potential for financing development can also be seen in emerging technologies. The hype about AI may not remain as high as it is now, but the potential for new, more efficient, and targeted solutions is big, like in agriculture, management, creativity etc. The world of crypto finance is also at the beginning of developing its potential. One school of thought discusses the end of the existing banking systems; another warns us about risks. Both old and new technologies can either be used for the wellbeing of humans, or for destroying the environment.

Ethical benchmarks

All these volatile developments in financial markets lead to profound ethical questions: Which development and financial instrument is ethically positive or negative? Let us mention only seven criteria as benchmarks for value driven finance for development:

(1.) Does it serve the basic human need for the majority (or only for a few)?

(2.) Does it strengthen sustainability as a long term preservation of ecosystems (or continue to destroy the planet)?

(3.) Does it support inclusive communities and social peace (or increase conflicts and wars)?

(4.) Does it contribute to security from the local to the international level (or destabilize societies and lives)?

(5.) Does it lead to fair, mutual benefit-sharing (or increase unfair domination)?

(6.) Does it encourage an economy of sufficiency for all (or increase greed for a few)?

(7.) Does it increase human dignity and human rights (or increase dependency and oppression)?

Spiritual roots

Ethical values cannot simply be taught in business school, management training, or implemented by legislation and courts. Even though it is much needed, value-driven decisions and behaviour have to be deeply rooted in the inner self, in spirituality, and in religious roots. Many companies and countries in the west have become very secular and actively want to exclude religions. India has a long tradition of combining business and religious ethical values. I could observe it during the last four decades of my manifold visits and projects in India on a business, academic, NGO, and government level. Religions (in plural) are important to serve these ethical benchmarks (as they, unfortunately, also violate them in many cases, as all other sectors do).

Religions around the world and throughout millennia have been contributing in a major way towards responsible practices, business ethics, and finance ethics. These are also integral to the principles and orientations of Hinduism, Jainism, Sikhism, and Buddhism.

Integrated solutions

What are feasible solutions for value driven financing for development?

(1.) Profit optimisation instead of profit maximisation: Optimum profit is balancing the justified interests of all stakeholders, including shareholders, employees, the environment, the state, etc.

(2.) Impact investing instead of speculative investments: Investment should shift to people and regions that need it the most; and instead of being towards the latest techhype).

(3.) Fair competition instead of unfair exploitation: Competition is a motor for innovation and development, but only if it is not just power driven but also value driven, fair, and sustainable.

(4.) Anti-corruption: Corruption is still one of the major obstacles to efficient and sustainable financing of development. The minimal efforts towards reducing corruption are a scandal, as it is an abuse of power and increases insecurity, violence, and undermines trust.

(5.) Fair taxes instead of maximized tax avoidance or illicit tax crime: Public institutions from the local to the global level do not get the tax income as parliaments and governments decide by law. Tax avoidance, corruption by companies and individuals to lower or avoid tax payments, and other crimes are widespread. Integrated tax reforms are needed to balance income tax, corporate tax, speculation tax, CO2 tax, etc. Comparable to tax avoidance is the fact that a number of countries do not pay the agreedupon contributions to multilateral institutions. 50 countries did not pay their fee for 2023 to the UN by the end of 2023. The US alone owes 1.1 billion USD to the UN's regular budget for 2023 and 2024, plus additional arrears. The UN Secretary General, Antonio Guterres warned that the UN will be insolvent by August 2024 if member states do not pay their agreed-upon contribution.

(6.) Fair currency exchange: The current system with the USD as a global lead currency is not fair as it does not reflect the real strengths of national economies. In addition, the USA can accumulate almost endless debt that is, to some extent, paid by other countries. Since decades, experts have been advocating for a global basket of currencies as leading currencies. As it does not seem politically feasible, a counterweight through a BRICS+ currency basket as an alternative to the USD is geopolitically understandable. However, from an ethical point of view, a global basket of currencies would be much better, as it would reduce polarisation.

(7.) Creative debt transformation: The current dangerous debt crisis reminds us of the 1980s global debt crisis. Instead of a simple debt cancellation, a creative debt transformation in favour of key development sectors of indebted countries such as health, education, and nutrition would be a more value driven debt solution. Switzerland implemented it in the 1990s with its successful 2 billion CHF/USD program 'creative debt transformation'.

(8.) Honest communication on financial, ethical and political dilemmas instead of greenwashing and dishonest propaganda: Leaders in all sectors should be honored when they are honest, also in describing their dilemmas, constraints, weaknesses and need for cooperative solutions and help. In a number of cases, the collapse of companies could have been avoided or damage could have been reduced by a more transparent communication.

(9.) Integrating ethics and spirituality on all levels in the private, public, academic, and NGO sectors: Claiming that companies have to avoid any reference to their spiritual or religious roots denies the fundamental need of people for orientation and connectivity to spiritual resources, which give them energy, hope, and security.

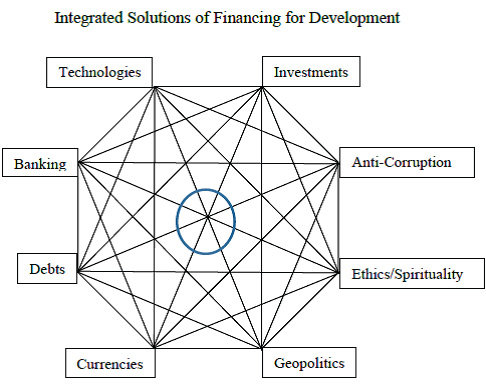

(10.) Integrated financing development instead of isolated solutions: The following graph below shows that financing development, needs a holistic perspective, recognising the interdependency of different dimensions of global and local finance. It needs leaders with integrated thinking, and with integrity, character, and decisiveness. This integrated approach is also valid for the 17 Sustainable Development Goals of the UN. Water, education, investments, security etc. are interdependent and lead to fruitful, efficient, and sustainable strategies and solutions.

He is the Founder and President of Globethics, the global ethics Foundation in Geneva, Switzerland, with an office also in Bangalore/India. He is a Professor of Ethics (emeritus at University of Basel/Switzerland, active visiting professor in Nigeria, China, formerly in Russia) with a PhD in Peace Ethics, a habilitation on sustainability ethics and two honorary doctorates. He has authored and edited over 80 books, including on business ethics, the last on 'Globalance towards a New World Order: Ethics Matters and Motivates'. He has also been an Advisor to the UN, Companies, NGOs, and Governments.

Owned by: Institute of Directors, India

Disclaimer: The opinions expressed in the articles/ stories are the personal opinions of the author. IOD/ Editor is not responsible for the accuracy, completeness, suitability, or validity of any information in those articles. The information, facts or opinions expressed in the articles/ speeches do not reflect the views of IOD/ Editor and IOD/ Editor does not assume any responsibility or liability for the same.

About Publisher

Bringing a Silent Revolution through the Boardroom

Institute of Directors (IOD) is an apex national association of Corporate Directors under the India's 'Societies Registration Act XXI of 1860'. Currently it is associated with over 30,000 senior executives from Govt, PSU and Private organizations of India and abroad.

View All BlogsMasterclass for Directors

Categories