Gold Standard ESG and Sustainability

Introduction to Sustainability Reporting

This short section on sustainability reporting is to get you tuned in to what sustainability reporting is all about. We will look at the definition of sustainability reporting, then consider the latest positions in the reporting environment, and wrap up the section with what needs to change.

The need and demand for change has made sustainability reporting a critical success factor in business. Reporting signals a responsible organisation, one that is dedicated to being open and honest with its stakeholders. Through reporting, organisation's can understand and better manage their impacts on people & the planet. UN experts want sustainability reporting to be a regulatory requirement with zero tolerance for net zero greenwashing.

Sustainability reporting refers to the process of reporting, which starts with an organisation determining its 'Material Topics', based on its most significant economic, environmental, and people impacts, including human rights impacts, and results in the organisation publicly reporting information about these impacts.

KPMG's Survey on Corporate Reporting 2022 surveyed 5,800 companies in 58 countries. The report evidences organisational performance and change to meet broader societal expectations. It was found that most reports are poor, failing in process and substance, lacking in their response to the Sustainable Development Goals, and emerging issues and risks, despite reporting being the most important area of work CEOs and boards face.

The need and demand for change has made sustainability reporting a critical success factor in business. Reporting signals a responsible organisation, one that is dedicated to being open and honest with its stakeholders.

Some key emerging issues and impacts include diversity; the report specifically identifies 'the Black Lives Matter movement', tax, energy, climate change, circular economies, digital economies, security, and human rights. As legislation shifts to mandate corporate sustainability reporting, more than 50 stock exchanges around the world require a sustainability report to be listed. 75% of Fortune 500 companies report using GRI.

Companies not reporting can find themselves out of step and being left behind. Organisations unable to demonstrate their capacity to operate sustainably will be overlooked by investors, clients, customers, peers, and other stakeholders.

Some of the legislative shifts include Sustainable Finance Disclosure Regulations for EU Asset Managers and Financial Advisors and the European Commission's adoption of CSRD starting in 2024. The UK Financial Conduct Authority proposes sustainability disclosure requirements; the Hong Kong Stock Exchange publishes mandatory climate disclosure guidance; the Singapore Stock Exchange issues mandatory disclosure recommendations on climate change and board diversity; and the EU is adopting proposals for a directive on corporate sustainability due diligence with rules for companies to respect human rights and the environment in their global value chains. The US SEC (Securities and Exchange Commission) proposes climate disclosures; China has a voluntary guidance for enterprise ESG disclosure; and the European Financial Reporting Advisory Board has the European Sustainability Reporting Standard, etc. While mandatory requirements ensure reporting rates grow, standards like GRI enable organisations to comply.

Sustainable Development Goals

The Sustainable Development Goals are 17 interlinked global goals designed to give everyone a chance to achieve a shared blueprint for peace, prosperity, and a more sustainable future by 2030. The 17 SDGs have 169 targets, delivered through over 200 indicators, or key performance indicators (KPIs). The SDGs provide a long-term North Star to guide businesses in value creation and planet protection.

The challenge for business is to come through with meaningful contributions to the global effort to achieve the SDGs. Organisations must appreciate their purpose relative to outward global, regional, and local sustainability issues. Principled Prioritisation is a four-stage process. Involving:

Step 1: Engage stakeholders to consider environmental and human impacts.

Prepare the business case – board approval

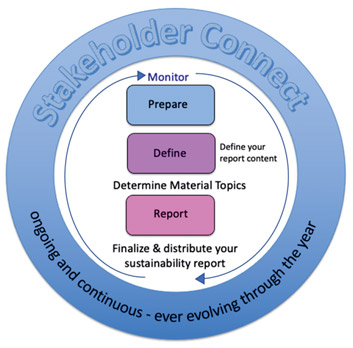

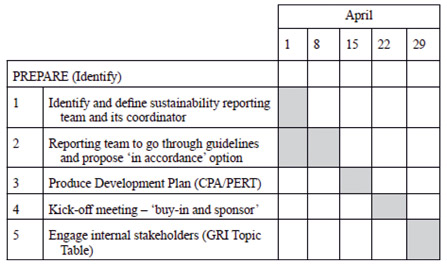

Prepare the Critical Path Program (CPA), showing the key activities. CPA is an excellent way to manage the delivery of the process through its Prepare, Connect, Define, Monitor, and Report phases.

Sustainability reporting process

Prepare

Prepare a phase timeline

Monitor

Setting procedures and targets, collecting data, and monitoring activities companies do are constant approaches to good leadership and management, but there is a massive bonus to be had: evidencing good governance supports positive investor, sponsor, and regulatory responses that drive up credibility and company growth. This phase also holds opportunities to formalize efficiencies and improvements.

In the twenty-first century, good reporting, systematic collection, and monitoring of both the organisations data and supply chain data is necessary to acertain the bigger picture of the organisations impacts and efficiencies.

The main characteristic of the monitoring phase revolves around the positioning of robust procedures and checking that they are properly used for the establishment of quality monitoring information, assurance, and verification. The acronym I call 'STAB Triple CV', mentioned in the section 'The Journey', forms a set of quasi-accounting principles that help organisations maintain a focus on collecting robust information from a base year and the management of material topics by setting SMART targets and goals.

Report

The writing of a sustainability report requires discipline and creativity. Remember, it is a public document and should hold meticulously accurate qualitative and quantitative information. The report should be a concise communication on how the organisation creates value in the short, medium, and long term.

This section will describe the key areas to clarify the content needed in a report, the different ways of presenting your report, and where help to make report writing automated can be found. The report should be written with accessibility for stakeholders in mind, ensuring the specific report readers' needs for key and critical information are being met.

Company accreditations

The reality is that companies and their stakeholders must decide on the data they want to report relative to each framework demanding the data. But it certainly helps to use standards that have overlayed and harmonised metrics because the end reports for each standard can carry and discuss the same data. It is usual for respective reports to indicate any other standards the reporting organisation responds to.

How do the GRI Standards relate to other environmental and sustainability standards? GRI has formal 'linkage documents', which provide guidance for using GRI reporting in combination with other standards such as IIRC, Carbon Disclosure Project (CDP), ISO Standards, UN Global Compact, UK Mandatory GHG Reporting 2013, Organisation for Economic Co-operation and Development (OECD) Guidelines for Multinational Enterprises, UN Guiding Principles for Business and Human Rights, and GRESB-Global Real Estate Sustainability Benchmark. GRI also links with the UN Sustainable Development Goals and the EU Non-Financial Reporting Directive, which evolved to become CSRD, the EU Corporate Sustainability Reporting Directive. In addition, emerging governmental and global regulations and stock exchanges reference GRI as a compliant methodology.

Note: This Article is an excerpt from the book, 'Gold Standard ESG and Sustainability – A Step-by-Step Guide to Producing Corporate Sustainability Reports', May 2023.

Author

Mr. Kye Gbangbola

MBA FCIOB EurBE CIHCM Dip GDA PGDCM PGDDM CEnv FIEMA LCSAP GACSO is the Founder of Total eco Management Ltd. (TeM) an award winning sustainability consultancy that has fast become a leading light in the movement to improve the performance of organisations. Mr. Gbangbola, a recognised European building expert, has over twenty years director level experience in the property and construction sector.

Owned by: Institute of Directors, India

Disclaimer: The opinions expressed in the articles/ stories are the personal opinions of the author. IOD/ Editor is not responsible for the accuracy, completeness, suitability, or validity of any information in those articles. The information, facts or opinions expressed in the articles/ speeches do not reflect the views of IOD/ Editor and IOD/ Editor does not assume any responsibility or liability for the same.

Quick Links

Quick Links

Connect us

Connect us

Back to Home

Back to Home