Regional Directors' Conclave 2024

The Institute of Directors, India – Mumbai Region, organised a regional conference on the theme 'Mitigating Risk through Effective Corporate Governance' on February 23, 2024. The conference was held at the Jio World Convention Centre, BKC, Mumbai. Many distinguished speakers, senior government officials, directors, and key decision makers from various companies attended the conclave. The conclave discussed themes related to corporate governance and risk mitigation, including government investment in infrastructure, empowering the MSME sector, board dynamics and efficiency, technology, and AI, to name a few. The conference was attended by more than 200 board members, key managerial personnel (KMPs), compliance professionals, and senior executives to take note of the latest transformations of boards and processes and how these can be beneficial to their organisations and institutions. The interactive nature of the conclave enabled the sharing of perspectives between experts and the audience.

Opening Session: Government support through Investment in Infrastructure

The 'Opening Address' was delivered by:

Mr. Sitaram Kunte, IAS (Retd.)

Honorary Chairman - Mumbai Region, Institute of Directors, India

former Chief Secretary, Govt. of Maharashtra

Mr. Kunte extended a warm welcome to all the distinguished speakers and the audience to the event. He provided a glimpse of IOD's emergence as a trusted partner for directors seeking to enhance their skills, navigate regulatory complexities, and stay abreast of emerging trends and developments. He also briefed the audience about the theme and panel discussion topics. He expressed that at the heart of effective risk management lies corporate governance the system of principles, policies, and practices by which organisations are directed and controlled. He stressed the importance of risk mitigation to navigate business complexities. He stated that in the contemporary corporate landscape, boards should possess sufficient capacity, quality, and quantity to facilitate India's growth trajectory. He outlined the IOD's mission to foster networking, knowledge sharing, community development, and societal contribution within boards. He advised boards to go through periodic training so as to keep themselves updated. He concluded his opening speech by appealing to everyone to reaffirm the commitment to uphold the highest standards of governance and leadership excellence, to drive sustainable growth, and create value for all stakeholders.

The 'Special Address' was delivered by:

(1.) Mr. P. D. Malikner, IAS

Managing Director - Maharashtra Industrial Township Limited

(2.) Mr. Deependra Singh Kushwah, IAS

Development Commissioner (Industries)

Chairman (MAITRI)

(3.) Mr. Balfour Manuel

Managing Director - Blue Dart Express Ltd.

Mr. Malikner gave an overview of government investment interventions in infrastructure projects in Maharashtra. He assured the audience about the government's commitment to development. He shared crucial aspects of some major projects undertaken by MIDC and MITL, such as the Aurangabad Industrial City (AURIC; now MITL), India's foremost greenfield industrial smart city. He stated that such smart zones are the backbone of India's high capacity transport network and are crucial to promoting local commerce, enhancing investment, and attaining sustainable development. He expressed with confidence that this will help our country truly be 'Vikasit Bharat' and on its way to becoming a thirty trillion dollar economy by 2047. According to him, the goal of government investment in infrastructure is clear, i.e., to bring down the cost of logistics. He also mentioned the efforts of the Maharashtra government to connect tier II and tier III cities with urban development centers. He concluded his speech by saying that the role of governmentindustry partnerships in unlocking infrastructure investment potential cannot be overstated. He said, “The collaborative approach of government investment in infrastructure and private investment from esteemed companies will unlock the potential of innovative projects like AURIC." He then invited the audience to explore and invest in infrastructural projects to build future ready industrial bases in Maharashtra.

Mr. Kushwah provided an overview of government infrastructure projects in Maharashtra. With an informative PowerPoint presentation that contained various examples, he explained why Maharashtra has a very mature infrastructure. He specified the government's intent to come up with a circular economy policy that will focus on recycling and reusing most industrial products. He underscored the importance of policy support to complement the infrastructure. He further mentioned some strong policy initiatives by the Maharashtra government, such as the Green Hydrogen Policy, Renewed IT and ITS Policy, Textile Policy, EV Policy, etc. He explained a certain package scheme of incentives for 2019 and stated the three main principles of this policy, which are: regional balance, prioritizing certain sectors, and customising for diverse investments. He highlighted the importance of MAITRI, which is a single window system to promote ease of doing business. He expressed his confidence that these initiatives will lead Maharashtra towards becoming a $1 trillion economy in the near future.

Mr. Manuel declared, “If there is no clear way of doing it, don't do it." He narrated the importance of connectivity and infrastructure by giving the example of flights being used to carry oxygen and basic supplies. He expressed his expectation and confidence in the infrastructure growth in Maharashtra in the coming years. He highlighted the importance of having a conscious keeper in corporations. He said, “It takes twenty years to build a reputation and five minutes to destroy it," and urged everyone not to make this five minute mistake. He explained the importance of compliance in risk mitigation, especially highlighted that compliance is non-negotiable, and declared that 100% compliance is the best strategy. He added, “If you think compliance is costly, try non-compliance”. He concluded by stating the benefits and importance of strictly following human rights and principles of diversity and inclusion.

Plenary Session – I: Corporate Finance Strategies for Thriving in the World's Third Largest Economy

The 'Chair Address' was delivered by:

Mr. Aliasgar S. Mithwani

Chief General Manager - Securities and Exchange Board of India (SEBI)

The Session had the following distinguished speakers:

(1.) Ms. Khyati Maheshwari Chief Financial Officer & Executive Director (South Asia) - Wella Company

(2.) Dr. Sujata Seshadrinathan Director - Strategies & IT, Basiz Fund Services

(3.) CA. R. Jayaprakash Finance professional - Mentor & Advisor to early stage entrepreneurs

Mr. Mithwani began his speech by narrating an anecdote that emphasised the challenges of not having a regulatory framework in place in the organisation, and how it can lead to the downfall of even a well established business. He stated that corporate governance and compliance are of utmost importance. He gave an overview of the Indian economy and set the context for the discussion. “Every calamity has blessings in it," he said while sharing how UPI grew during the pandemic. He concluded his remarks by stating, 'The role of fintech companies is to disrupt the market'. He further added that market disruptions are important for the development of the economy in the long run. He then proceeded to engage with the rest of the panel. He concluded the session by highlighting four salient points: there is a need to educate entrepreneurs; planning is significant; an additional mode of business will be challenged during crises; and technology can be used for effective corporate governance.

Ms. Maheshwari recounted the various ways corporate governance assists in risk management. According to her, corporate governance plays a crucial role and provides a framework for businesses to manage and implement risk mitigation strategies. It helps corporations identify, assess, and monitor risks and enables them to assign accountability. It fosters collaboration between stakeholders, the board, and the management. Regular reporting demonstrates the risk appetite of a company and keeps internal and external stakeholders in the loop. It ensures that companies are compliant and adhere to the norms and rules of the land. While discussing strategies during a financial crisis, she opined that, most of the time, economic crises foster considerable innovation within a company. Crises force companies to run their businesses at lower costs and be more creative and efficient. Only preparation builds resilience, and in times of crisis, businesses can stay resilient by incorporating internal and external collaboration, understanding the local context, investing in talent, and practicing corporate governance.

Dr. Seshadrinathan discussed the importance of corporate governance, especially in fintech companies. According to her, if a company wants to build sustainable value, corporate governance is a must. She shared her observation about how, generally, fintechs are so keen on creating valuations for themselves that they usually do not prioritise financial planning. She further added that financial planning and business planning should go hand in hand. She advised young fintech entrepreneurs to tap into the available experience of established professionals and measure the risk if they are to achieve greatness. She highlighted the importance of every stakeholder while discussing financial strategies for dealing with crises. She stated that every single stakeholder is a responsibility centre in a strategy. Any small failure by any stakeholder can collapse the whole system. Drawing from her experience, she emphasized the importance of having a combination of automation and human element. She appealed to the audience to always remember that the top line is 'vanity' and the bottom line is 'sanity'.

CA Jayaprakash reiterated the need to learn from experience. He gave the example of the transformation of Khandavaprastha into Indraprastha in the Mahabharata. He said that Indraprastha failed mainly because Pandavas relied only on themselves, and similar mistakes lead to failure in the corporate scene. With this being said, he underscored the importance of independent boards and corporate governance. He remarked that faulty capital planning is the primary reason for failure for many companies. He went on to discuss the importance of addressing the problem of capital systematically. While discussing an appropriate dividend policy, he highlighted the importance of identifying the ultimate capital providers. He observed a trend where capital providers exit in a short time frame, as in just four to five years. Hence, the board should factor in exits and not dividends in the overall strategy.

This was followed by an interactive Q&A session with the audience.

Plenary Session – II: Risk Mastery 2.0: Cultivating Foresight and Resilience in a VUCA World

The Session was chaired by:

Mr. Hersh Shah, SIRM

Chief Executive Officer - IRM India Affiliate

The Session had the following distinguished speakers:

(1.) Mr. Rajesh Jogi Non-Executive Director - Ujjivan Small Finance Bank & Xander Finance Pvt. Ltd.

(2.) Mr. Pravin Sawant Sr. Vice President & Chief Human Resources Officer - 63 Moons Technologies Ltd.

(3.) Mr. Chirag Naik Associate Partner - MZM Legal LLP

(4.) Mr. Shourya K. Chakravarty Chief Human Resources Officer - Aptech Limited

Mr. Shah began by setting the context for the discussion. He emphasized the importance of having a risk culture to be able to master the risk. He stated that more than VUCA, we are in the BANI, i.e., brittle, anxious, non-linear, and incomprehensible world. He made the statement that risk, defined as the effect of uncertainty on objectives, is everyone's responsibility. He stated that every person in the company has a professional and personal objective. He said that the alignment of personal objectives, departmental objectives, and company objectives is crucial for effective risk management. Towards the end of the session, he stated the following key insights: culture is of the utmost importance; risk is everyone's responsibility; not to outsource compliance; and make sure that you are tracking emerging regulations.

Mr. Jogi said that the role of risk in the boardroom has elevated significantly. According to him, the board's influence on the agenda for risk is very crucial. He stated the importance of looking at the bigger picture. In his opinion, risk identification is key. He expects boards to search for and identify the risks that management has overlooked. He also alerted the audience about the risk of groupthink on the board. He shared that group thinking is very common. To avoid the risk of groupthink, he encouraged directors to be contrarians and speak up for different perspectives when necessary. This, according to him, will benefit companies in the long run. He shared three powerful messages that can shape the future of risk, governance, and compliance. He further stated that organisational culture is ultimately a behaviour and is shaped by carrots and sticks. He stressed the need to envision a corporate culture and offer rewards to those who help build it.

Mr. Sawant addressed the latest talent trends and the role of HR leaders in accommodating the impact of the young generation on businesses. He mentioned how India has about 65% of the working population, with an average age of 28. According to him, the younger generation has taken to what is known as 'revenge travel' as a result of realizing how uncertain life can be. Given that the workforce of the current generation is so nimble, it is imperative that we address their need for quick gratification. He talked about the importance of being active on social media and drawing in talent by providing them with ideas to ponder. He opined that if organisations become innovative and take into consideration the younger population's aspirations, they will sustain the game and prosper together. He further addressed the issue of AI and its effect on risk management and the lives of people. He clearly stated that human intelligence outpaces technology and that a challenge is recruiting the right talent. At the same time, he acknowledged the role of AI in selecting the right talent.

Mr. Naik discussed three types of risks: known, unknown, and unknowable. He stated the need for cultural change in India to be at the top of the compliance regime. He added that without a cultural base, regulatory controls cannot translate into effective risk management. He underscored the importance of incentive compatibility in risk management and corporate governance. He spoke about setting up the right legal programme to mitigate risk. He narrated an incident of whaling and explained how adhering to the basic regulatory framework helps in avoiding such incidents. He highlighted the importance of developing a culture of asking questions. He advised everyone to have a basic and simple compliance programme and avoid designing a programme that is too complicated.

Mr. Chakravarty spoke about risk management and stated that ethical conduct is non-negotiable. He advised all to look inward and innovate outward. He said that scalability is at the core of everything. He noted the need to align personal objectives with organisations' objectives and work to achieve them in a disciplined manner. While emphasizing the need for planning, he highlighted the importance of changing the plans if the market situation so demands. He advised the audience to accept different perspectives and appreciate ambiguity in a situation. He concluded by stating that risk is a part of business, and hence, identifying, internalizing, and responding to changes quickly is key to success. He further said that risk management goes beyond adhering to laws. He made it clear that it is the responsibility of the HR departments to conduct periodic sessions and make sure that employees are aware of the dos and don'ts. He stated that talent, especially at the senior level, is one of the key areas of risk. He mentioned the need for skilling and upskilling to build the right talent pool and added that NEP 2020 can prove helpful in the same.

This was followed by an interactive Q&A session with the audience.

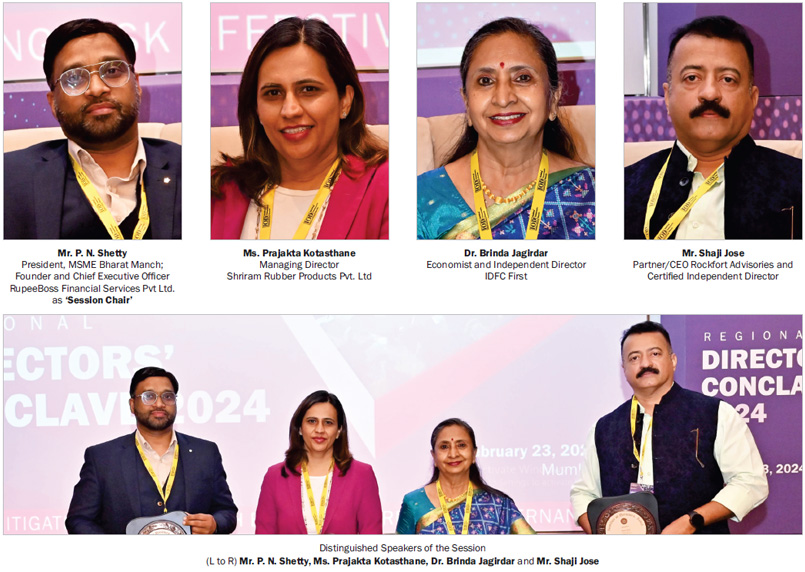

Plenary Session – III: Empowering the MSME Sector through Finance: Role of Government and Large Enterprises

The Chair of the Session was:

Mr. P. N. Shetty

President, MSME Bharat Manch & Founder and CEO, RupeeBoss Financial Services Pvt Ltd.

The Session had the following distinguished speakers:

(1.) Ms. Prajakta Kotasthane

Managing Director - Shriram Rubber Products Pvt. Ltd. (2.) Dr. Brinda Jagirdar

Economist and Independent Director - IDFC First (3.) Mr. Shaji Jose

Partner/CEO Rockfort Advisories and Certified Independent Director

Mr. Shetty began by quoting Mr. William Edwards Deming, “In God, we trust, all others must bring data.” He discussed how the unavailability of quality data regarding MSME is the biggest challenge in India. He also expressed his concern about MSME not getting representation at many events and discussions concerning MSME issues. He then appealed to the audience to have more interaction with the MSME. When talking about credit availability to MSME he predicted that in the coming one or two years MSME can get a loan within a day. This, according to him, will be possible because of the integration of Banking data, credit and GST data on ONDC platform. He also pointed out the very high interest rates of Cash flow based credit rating and added that such high interest were not affordable to many MSME.

Ms. Kotasthane spoke about ESG in MSMEs. She mentioned that MSMEs contribute about 35% to the economy. She said that there is a need to create the necessary mechanisms and infrastructures to support the MSME sector in the global landscape. She listed four important aspects: access to finance; access to a trained workforce; use of digital solutions; and compliance with international standards. While she mentioned and acknowledged the role and impact of government schemes like 'Make in India', she also expressed the need for even more efforts, not only from the government but the entire ecosystem, including large customers and SMEs. She further said that what fits in an ESG framework can be challenging, and hence clear guidelines are necessary.

Dr. Jagirdar stated that MSMEs are the backbone of the country. She expressed her concern about the MSME sector getting just 12% credit in spite of being a major contributor to the economy and being the second largest employmentcreating sector in the country. She mentioned the top three concerns related to MSME, i.e., finding the right talent, high operating costs, and access to credit. She also mentioned climate change as one of the major challenges faced by MSMEs today and expressed her skepticism about the preparedness of the MSME sector to face this looming challenge. She also spoke about cluster development and mentioned the many benefits of clusters for MSMEs, such as easier access to industry specific talent, suitable infrastructure, increased capacity for operations, and the drive to be more competitive. She also explained how collateral for most MSMEs is a challenge. She listed the various government schemes that are helpful in providing credit to MSMEs.

Mr. Jose highlighted single ownership and the 'I-me-myself' attitude as the major factors that prevent Indian MSME from becoming 'Glocal'. He also mentioned dwarfism in MSMEs, which is the unwillingness to come out of their shell and expand. According to him, Indian MSMEs have all the talent, products, and information, but the lack of lean management and vision are the major challenges. He advised everyone to follow the rule of 99% planning and 1% implementation. He appealed for tremendous government support for the MSME sector, especially the micro and small industries.

This was followed by an interactive Q&A session with the audience.

Plenary Session– IV: Board Dynamics and enhancing efficiency of various Board Committees

The Session was chaired by:

Mr. B. Renganathan

Corporate Law Advisor

The Session had the following distinguished speakers:

(1.) Mr. Sreeji Gopinathan

Global Chief Information Officer - Lupin Limited (2.) Mr. Dharmarajan Sankara Subrahmanian

Founder & Chief Executive Officer - Impactsure Technologies (3.) CA C. Ramulu

former Finance Director - Hindustan Petroleum Corporation Limited

Mr. Renganathan opened the session by stating that ethics cannot be taught; it has to come from within. He mentioned the two types of governance: one being principle based governance and the other having a tick the box approach. He expressed the need to change the culture from a tick the box approach to a principle based approach. He urged directors to not restrict themselves to just board meetings. According to him, an independent director should contribute to the company by being proactive. He urged the independent directors to look up Section 149, Subsection 12, of the Companies Act, 2013, and added that that was the mantra for becoming a good independent director. He appealed to the directors to not hesitate to ask questions of the management when necessary.

Mr. Gopinathan highlighted the importance of proper representation of risk. He stated that it is crucial for organisations to be aware of their internal capability for dealing with risk. He added that an organisation should strike a balance between internal capabilities and external trends. He advised boards to be aware of the group-thinking tendency of a board. The challenges posted by modern technology, like cyber risk and digital data security risk, were also mentioned by him. He also expressed his views from a regulatory point of view by saying that “information asymmetry is a risk if the right information is not flagged at the right time." He stated the importance of a topdown tone setting from top leadership to make sure that we get sanitized, digitized, and real-time data. He added that there are many AI generative tools that help make board functions smoother. He also discussed the role of chief technology officers and said that there is a need for a mindset change in how the board perceives CTOs. He concluded his remarks by stating that while technology is great, we have to use it responsibly and carefully.

Mr. Subrahmanian stated that AI is the new steam. He remarked that every business is becoming digital, and technology is here to stay. He said that there is no option but to adapt to changing technologies. He mentioned that boards in companies are upskilling themselves technically, and more board members than ever are becoming tech savvy. He also highlighted how directors are expected to have technical acumen along with knowledge and experience in risk management and governance. He appealed to directors to be cognizant of the gray areas, i.e., ethics in business. He also discussed whether a board may be held accountable for unethical behaviour within a company. With regards to technology, he said that it is becoming an enabler in every aspect of business. According to him, technology can take care of mundane processes and help managers focus on decision making. He appealed to the audience to use technology in the best possible way.

CA Ramulu presented an engaging PowerPoint presentation, displaying how boards can help companies navigate risk and opportunity in the digital landscape. He stated that the new digital economy has significantly transformed risks and explained how we need to enable ourselves to face new risks. He said that the audit and risk management committees are a vital link between statutory auditors, internal auditors, and the board. He added that the rapid pace of technology has disrupted traditional business models, and this has resulted in creating opportunities as well as risks. Cybersecurity, data security, privacy concerns, and data protection are some new areas of risk, according to him. He mentioned that the role of the board is to grapple with these complex risks. He emphasized the need for proactive risk management. He expressed the need to adopt an agile and forward looking approach to risk assessment and management. He emphasized the importance of the role of internal auditors and mentioned that every activity in a company can be subjected to an internal audit. He said, “Auditing is not only detecting frauds but much more than that; auditing is compliance." He urged all the attendees of the conclave to always do a little more than what is required.

This was followed by an interactive Q&A session with the audience.

This was followed by a felicitation ceremony to welcome the newly joined IOD Fellows and Life Members from the Mumbai Region.

This was followed by the 'Chairman Address' delivered by:

Mr. Sitaram Kunte, IAS (Retd.)

Honorary Chairman - Mumbai Region, Institute of Directors, India

former Chief Secretary, Govt. of Maharashtra

Mr. Kunte thanked and expressed gratitude to all the attendees. He extended his sincere thanks to the event sponsors and partners for their unwavering support and collaboration. A special mention was given to the members of the organising committee and volunteers for their tireless work behind the scenes.

Ms. Priti Arora, Regional Manager, Institute of Directors, Mumbai Region, proposed the 'Vote of Thanks'. She conveyed sincere thanks and gratitude to the distinguished chief guests, esteemed speakers, and delegates. She also extended special thanks to the event partners. She concluded by announcing the upcoming Masterclass for Directors - training programme batches, and IODs' upcoming UAE Global Convention 2024 to be held during March 5-8, 2024 in Dubai and Abu Dhabi.

IOD is especially grateful to its event partners:

Our Silver Partners:

(1.) AURIC (MITL: Maharashtra Industrial Township Ltd.)

(2.) Shriram Rubber Products Pvt. Ltd.

Our Supporting Partner: Bluedart Express Ltd.

This report is compiled by

Mumbai Regional Team

Institute of Directors

GLIMPSES OF AUDIENCE

PARTNERS & SUPPORTERS

Author

Institute of Directors India

Bringing a Silent Revolution through the Boardroom

Institute of Directors (IOD) is an apex national association of Corporate Directors under the India's 'Societies Registration Act XXI of 1860'. Currently it is associated with over 31,000 senior executives from Govt, PSU and Private organizations of India and abroad.

Owned by: Institute of Directors, India

Disclaimer: The opinions expressed in the articles/ stories are the personal opinions of the author. IOD/ Editor is not responsible for the accuracy, completeness, suitability, or validity of any information in those articles. The information, facts or opinions expressed in the articles/ speeches do not reflect the views of IOD/ Editor and IOD/ Editor does not assume any responsibility or liability for the same.

Quick Links

Quick Links

Connect us

Connect us

Back to Home

Back to Home