A Report - Mumbai Regional Conference 2025

The Mumbai Regional Conference 2025, organized by the Institute of Directors (IOD), Western Region, was held on May 24, 2025, at the BSE International Convention Hall, Mumbai. The event theme was “Governance and Growth through Reputation: Insights from Maharashtra”.

This landmark gathering brought together senior government officials, corporate leaders, regulators, and reputation strategists to explore how reputation as a strategic asset can drive sustainable growth, investment, and governance excellence. Through a series of plenary sessions and fireside chats, the event highlighted the pivotal role that trust, ethical leadership, communication, and innovation play in building reputational capital across public and private institutions.

With the Vision: “Maharashtra's trillion-dollar economy by 2030”, the discussions offered deep insights into state branding, financial sector resilience, customer-centric innovation, and the institutionalization of reputation in corporate culture. The conference also served as a platform for sharing best practices, fostering collaborations, and reinforcing the importance of integrity and stakeholder trust in shaping the future of governance and development.

Plenary Session I:

Maharashtra's Trillion-Dollar Vision: Harnessing Reputation for Economic Transformation

The conference commenced with a compelling Opening Session that set the tone for the day's deliberations. Centered around Maharashtra's ambition of becoming a trillion-dollar economy, this session explored how the strategic cultivation of reputation can drive economic transformation. It emphasized the vital role reputation plays in attracting global capital, positioning the state as a trusted investment destination, and creating a blueprint for institutions and leaders to follow. The session brought together eminent policymakers and reputation strategists to reflect on Maharashtra's brand journey and its implications for economic governance and growth.

The 'Opening Address' was delivered by:

Mr. Sitaram Kunte, IAS (Retd.)

Chairman, IOD Western Region

Former Chief Secretary, Govt. of Maharashtra

Mr. Kunte emphasized that reputation is not a static reflection of past deeds, but a forward-looking tool for economic and governance transformation. Highlighting Maharashtra's cultural and institutional strengths, innovation, transparency, and accountability, he outlined how these values have made the state a hub for investment and trust. He stressed that businesses must use communication and innovation to earn loyalty in a customer-driven economy. Reputation requires sustained effort and is built by consistently upholding public trust. He called for leaders to treat reputation as a dynamic force central to governance and growth, asserting that Maharashtra's journey toward becoming a trillion-dollar economy will depend heavily on how well it harnesses and institutionalizes its reputational capital.

This was followed by 'Special Address' delivered by:

(i.) Dr. Prashant Narnaware, IAS

Secretary to the Governor

Govt. of Maharashtra

(ii.) Mr. Neeraj Jha

Founder & MD

Neeraj Jha Brand & Reputation Advisory

Dr. Narnaware described Mumbai's rise as India's financial capital as an “accident of prudence” shaped by decades of sound policy. He stressed that Maharashtra's reputation extends beyond Mumbai, citing significant investments and development in tier-2 cities. Calling for tax reforms and ease-of-doing-business improvements, he linked state reputation to investor trust. He highlighted initiatives such as the Mitra university program and the Mahila Sashaktikaran Yojana that support inclusive, reputationled growth. Education, MSME support, and liquidity injections are all part of this vision. He concluded that reputation must be democratized, not just preserved by elites but co-created by every visionary and ethical contributor in the system. A $1 trillion economy, he insisted, must be built on shared prosperity and collective integrity.

Mr. Jha called Mumbai “reputation in action”, linking the city's global appeal to its cultural fabric, meritocracy, fairness, and openness. Citing BSE as a symbol of India's financial credibility, he emphasized that trust is Maharashtra's strongest currency. He differentiated between image and reputation, asserting that while image can be curated, reputation is earned through long-term integrity. Highlighting four foundational elements - attitude, ethos, values, and culture, he praised Maharashtra for consistently upholding these across politics, administration, and industry. He argued that true reputation is defined by what people say after years of knowing you, not during campaigns or crises. His concluded his remarks with a message that reputation must be nurtured intentionally and authentically, not managed superficially.

This was followed by 'Guest of Honour Address' delivered by:

(i.) Ms. Kamala K.

Chief Regulatory Officer

BSE Limited

(ii.) Mr. V. S. Sundaresan

Executive Director

Securities and Exchange Board of India (SEBI)

Ms. Kamala stressed that governance, not publicity, is the bedrock of reputation. She cited BSE's 150-year legacy as a testament to sustained governance and investor trust. Recalling failures due to weak governance, she noted that strong systems empower organizations to innovate, scale, and deliver consistently. She highlighted India's shift from a saving-centric mindset to a market-investing culture and credited stock markets for enabling capital formation. Encouraging mentoring of new-age entrepreneurs, she emphasized value-based execution and emotional intelligence. In today's digital age, she warned, one misstep can undo years of trust. Thus, agility and tech adoption must be balanced with human-centric governance. She emphasized to nurture values, mentor successors, and uphold governance as the true engine of growth.

Mr. Sundaresan emphasized that in finance, reputation is the ultimate collateral. While goodwill isn't recorded on balance sheets, its value becomes immediately visible during fund-raising and crises. He described SEBI's approach to regulation as being grounded in predictability, transparency, and enforcement - pillars that sustain market trust. Maharashtra, contributing 30% to India's capital markets, exemplifies how financial reputation fuels national growth. He noted the dramatic rise in retail investor participation and credited India's regulatory system for fostering confidence. Citing Warren Buffett's quote on how fast reputation can be lost, he urged that Governance, Reputation, and Credibility (GRC) be treated as core economic pillars alongside GDP.

He concluded his remarks with a challenging thought: Can India export governance the way it exports tech talent?

The 'Chief Guest Address' was delivered by:

Mr. P. Velrasu, IAS

Chief Executive Officer

Maharashtra Industrial Development Corporation (MIDC)

Mr. Velrasu provided a government leader's perspective, calling reputation a generational and cultural asset built through sustained ethical leadership. He emphasized that Maharashtra's ability to attract investment $125 to $135 billion is due to transparent, policy-driven governance and infrastructure like Aurangabad Industrial City (AURIC) and Mumbai Trans Harbour Link (MTHL). He shared examples of Maharashtra's digitization, UMANG, DigiLocker, and MahaBhulekh that support ease of doing business. Infrastructure investments in pipelines, EV charging, and logistics zones demonstrate the state's shift from land allocation to ecosystem creation. He urged bureaucrats to act on ethical convictions, citing Late Lee Kuan Yew, first Prime Minister of Singapore. He concluded by stating, reputation is not publicity, it's the outcome of consistent, values-based governance, requiring daily discipline from public institutions.

The Opening Session underscored that reputation is the cornerstone of sustainable growth, whether in governance, finance, industry, or public leadership. It is an outcome of ethical conduct, policy consistency, transparency, and cultural integrity. Reputation, as all speakers echoed, is not built in boardrooms alone, it is forged through decades of principled action and can be lost in minutes, making its preservation a collective and urgent responsibility.

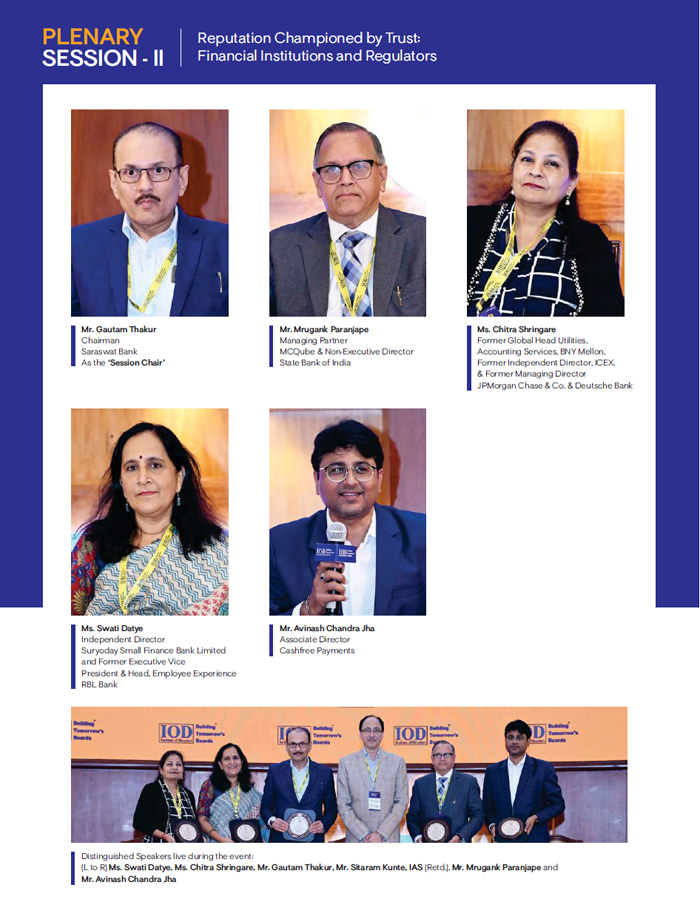

Plenary Session II:

Reputation Championed by Trust: Financial Institutions and Regulators

The panel underscored how deeply intertwined trust, regulation, and ethical conduct are in safeguarding the reputation of financial institutions. Speakers emphasized that compliance should not be seen as a hindrance but as a tool for instilling discipline and protecting stakeholder interests. Regulators, particularly in India, were praised for their evolving sophistication, responsiveness, and ability to balance market development with prudential oversight. Examples like the transformation of NSE, improved controls, and proactive engagement with stakeholders demonstrated how robust regulations can reinforce trust and elevate institutional reputation.

The session was moderated by:

Mr. Gautam Thakur

Chairman

Saraswat Co-operative Bank Ltd.

The Session had the following distinguished speakers:

1. Mr. Mrugank Paranjape

Managing Partner, MCQube

Non-Executive Director, State Bank of India

2. Ms. Chitra Shringare

Former Global Head Utilities, Accounting Services, BNY Mellon

Former Independent Director, ICEX, Former Managing Director

JPMorgan Chase & Co. & Deutsche Bank

3. Ms. Swati Datye

Independent Director

Suryoday Small Finance Bank Limited

Former Executive VP & Head

Employee Experience, RBL Bank

4. Mr. Avinash Chandra Jha

Associate Director

Cashfree Payments

Mr. Thakur argued that for financial institutions, reputation outlasts financial metrics. Planning for a 100-year legacy requires institutions to treat compliance and trust-building as long-term strategies. He praised India's regulators, especially RBI and SEBI, for fostering a balance between oversight and market freedom. Recalling how 65 regulatory returns were digitized, he advocated for more adaptive (“widen the crease”) regulation. For him, compliance isn't a burden but a safeguard. He foresees a shift from entity-based to activity-based regulation, reflecting how institutions actually function. Trust, he concluded, stems from transparent practices, collaborative regulations, and ethical leadership, factors more valuable than quarterly profits.

Mr. Paranjape shared his experience rebuilding trust at MCX, where fear and surveillance were once rampant. Through transparent leadership and strong regulation, he restored institutional credibility. He emphasized that being regulated is better than being unregulated. Regulations provide structure, credibility, and investor comfort. Recalling a roadshow with SEBI's former Chair, Mr. C. B. Bhave, he echoed Bhave's philosophy that regulations exist to empower honest actors, not hinder them. He praised Indian regulators for becoming proactive and tech-savvy, noting that data exchange via Application Programming Interfaces (APIs) now allows early detection of anomalies. He concluded, trust is co-created by ethical institutions and enabling regulators, and India's financial ecosystem is becoming a global benchmark due to this synergy.

Ms. Shringare recounted her role in shaping India's capital markets, from physical share certificates at BSE to digitized systems via NSE. She emphasized that doing the right thing when no one's watching is the foundation of reputation. Her work on clearing mechanisms at the Clearing Corporation of India Limited (CCIL), developed in just 60 days, won international praise and showed how robust systems build trust. She applauded Indian regulators for involving market participants in real-time feedback and adapting policies to facilitate Foreign Portfolio Investments. She concluded with, regulatory innovation, ethical conduct, and stakeholder collaboration have placed India among the world's most trusted markets, reflecting her pride in India's regulatory journey.

Ms. Datye emphasized that trust and reputation are inseparable in financial services. She recounted how malpractice tied to sales pressure damaged her bank's credibility, restoring it required more than numbers; it demanded ethical reform and transparency. She sees regulation not as restriction but as a framework for accountability and customer protection. Even routine tasks like re-KYC or verification calls are powerful trustbuilders. She noted that Indian regulators are wellinformed and vigilant, playing a crucial role in elevating institutional maturity. For her, trust emerges from every touchpoint - service quality, transparency, and governance and these must evolve with geography and consumer behaviour. She concluded by stating that she believes, reputation is a living currency backed by sustained integrity.

Mr. Jha highlighted that ethics is the cornerstone of reputation, and leadership must model it consistently. He questioned how many companies truly reward ethical conduct or reputation-building in performance incentives. To institutionalize trust, he urged leaders to embed it in policies and daily culture. Drawing from his Fintech experience, he shared how regulators and rating agencies are often mischaracterized as punitive when they are, in fact, open to dialogue and responsive. He stressed that reputation isn't accidental, it must be intentionally built, owned at every level, and championed from the top. He concluded with, when employees are empowered to uphold reputation, organizations gain resilience and credibility.

Plenary Session III:

The Customer is King: Reputation Championed by Innovation & Communication

The session was moderated by:

Ms. Renu Basu

Advisor & Former SVP – IHCL

Non- Executive Director, Rolex Watch Company Pvt. Ltd.

Independent Director at Unity Small Finance Bank, and

Nomura Capital (India) Pvt. Ltd.

The Session had the following distinguished speakers:

1. Mr. Alessandro Giuliani

Managing Director

SDA Bocconi Asia Center

2. CA A.V. Seshadrinathan

Founder & Managing Director

Basiz Fund Service Private Limited

3. Ms. Satinder Kaur

CEO & Founder, Skaur

Former Internal Ombudsman, Tata Capital

4. Mr. Shailendra Tripathi

Founder & Managing Partner

Growth Magnet Advisory LLP

Director, Novasis Healthcare Pvt. Ltd.

5. Mr. Ashish Das

Vice President and Country Head

Garfield Health Solutions (WoS of Kaiser Permanente)

Ms. Basu described reputation as the soul of a brand, shaped not by marketing teams but by every person in the organization. From her Tata Group experience, she stressed that legacy must be refreshed continuously with ethical leadership and purpose. She asserted that brands grounded in service, education, and ecological responsibility enjoy enduring credibility. CEOs, she noted, are now brand ambassadors whose behaviour directly influences perception. Drawing examples from HDFC, Mahindra, L&T, and Reliance, she illustrated how Indian firms have earned global respect through customer centricity, resilience, and storytelling. She concluded with the mantra of 'constituency, repeatability, and adaptability' as the building blocks of a powerful, trustworthy brand.

Mr. Giuliani emphasized that brand reputation is not inherited, it must be earned daily through innovation, authenticity, and clear communication. Reflecting on SDA Bocconi's India journey, he stressed understanding cultural context, localizing narratives, and adapting messaging. In the age of social media democratization, he noted that communication is both opportunity and risk. He cited how Indian craftsmanship was repositioned globally through creative storytelling, showing that perception and identity can be redefined with vision. He encouraged Indian family businesses to adopt a long-term view and prioritize human connection over vanity metrics. Increasing preference among Indian students for Global Capability Centers (GCCs) reflected this shift. He emphasized that lasting reputation is built through detail, respect, soft skills, and people-first branding.

CA Seshadrinathan advocated for deliberate, sustainable growth anchored in financial prudence. He warned against vanity metrics, emphasizing that “top line is vanity, bottom line is sanity, and cash is king.” Reflecting on Basiz Fund's journey, he shared how repeatable processes and value systems enabled credibility. The PPP framework - People, Process, and Purpose is essential for sustaining brand trust. People deliver the promise, processes protect it, and purpose defines it. He likened business leadership to being on a treadmill, constantly moving to stay relevant. Ethical decision-making, strong governance, and stakeholder stewardship were his pillars for long-term value creation. He concluded by mentioning that reputation is not built on PR but on daily discipline and consistent behaviour.

Ms. Kaur emphasized that responsiveness is the heart of brand reputation in today's digital age. Customers now expect not just timely service, but empathy and ownership. Sharing a personal anecdote about a fraud incident, she showed how emotional connection and care create trust beyond resolution. She argued that reputation isn't about slogans or metrics, it's about how brands make people feel, especially in distress. Technology is essential, but it must never replace the human touch. She asserted that internal empowerment from top leadership to frontline staff is key to delivering consistent, empathetic service. She concluded with, reputation is a cultural practice, not a marketing function and organisations must humanize digital interactions and ensure that every customer feels heard, valued, and protected.

Mr. Tripathi stressed that reputation in today's world walks on two legs - people. A brand's promise is delivered by individuals and protected by systems. Recalling a pharma industry example, he explained how a sales manager's personal credibility influenced product acceptance. He outlined the PPP model: People deliver, Processes protect, Purpose defines, a framework for building lasting brand trust. He warned that without robust processes, even the best people can fail to uphold service consistency. In an era dominated by social media and low customer patience, product quality alone is insufficient. Reputation must be earned through alignment of values, communication, and daily conduct. He concluded, modern brands must blend storytelling with purpose and people-centric delivery to stand out.

Mr. Das highlighted how Global Capability Centers (GCCs) have transformed from back-office units to innovation powerhouses. Recalling his journey from a small hotel team to 4,000 employees in three years, he illustrated how purposeful growth and operational excellence shape institutional reputation. He stressed that GCCs now codevelop products, hire more than traditional IT firms, and serve as preferred workplaces due to work-life balance, culture, and career stability. Das urged policy support to integrate GCCs into national strategy. His message: quality, consistency, and stakeholder responsiveness build brand equity, and India's GCCs have evolved into credible, global contributors. Innovation, he argued, is not only product-driven but culture and people-driven, defining modern organizational reputation.

The session shifted the spotlight to customers, emphasizing that reputation today extends far beyond product quality, it is shaped by people, purpose, and storytelling. Panellists examined how innovation, brand communication, and value-driven narratives have helped companies evolve into trusted brands. As Ms. Basu shared that “People are the custodians of a brand, not the PR team or Corporate Affairs.”

This was followed by an interactive Q&A with the audience.

Plenary Session IV:

Reputation Matters: Boardroom Perspectives

The session was moderated by:

Dr. Divya Jaitly

Founder & MD

Forethought Corporate Communications Pvt. Ltd.

Author & Motivational Speaker

Qualified Independent Director & Board Advisor

Dr. Jaitly opened with a Warning: In a hyper-connected world, reputation can be destroyed faster than it is built. She emphasized that reputation is not created through PR or press releases but through authentic, values - aligned actions. Organisations must distinguish between openness and overexposure, and ensure that what they project externally is rooted in internal truth. She argued that reputation is no longer a communications department's task, it's the responsibility of the entire leadership. Inconsistent messaging, performative communication, and hollow promises quickly backfire. She advised Boards to stop talking about reputation and start living it visibly and credibly. She highlighted that in today's environment, reputation must be earned minute by minute, across all levels of leadership.

The 'Keynote Address' was delivered by:

Mr. Arun Raste

Managing Director & Chief Executive Officer

National Commodity & Derivatives Exchange Limited (NCDEX)

Mr. Raste shared, Boardroom Leadership is like hockey and mountaineering, requiring panoramic vision, agility, and emotional strength. He asserted that reputation is now a strategic asset, not a soft consideration. Social media ensures that every board decision is under public scrutiny. He recounted corporate crises where boards that owned their mistakes and communicated transparently managed to emerge stronger. For him, Board's role in Crisis Response is vital, it must take charge, apologize with sincerity, and show a roadmap to recovery. He called social media both a boon and a bane, amplifying both strengths and missteps. Reputation is a boardroom issue and must be led with empathy, truth, and accountability.

The session concluded on the note that in an era of rising visibility and stakeholder activism, reputation is a shared responsibility led by the board, but owned across all levels of an organisation. Resilient leadership, humancentric values, and transparent communication are the cornerstones of enduring corporate reputations.

Plenary Session V:

Institutionalizing Reputation within Organizations

The session was moderated by:

Mr. Neeraj Jha

Founder & MD

Neeraj Jha Brand & Reputation Advisory LLP

Former Group President & Chief Communications Officer

Bajaj Group, Bharti Airtel Ltd, and HDFC Bank Ltd.

Mr. Jha began by highlighting the distinct cultural strength of Maharashtra, which he believes plays a vital role in the state's overall development. He remarked on the civility and safety he has observed during his time there. Turning to the theme of institutionalizing reputation, he emphasized that it begins with identifying a problem clearly and treating it systematically. He stressed that institutionalization means more than policy, it requires action and accountability. He mentioned that to truly institutionalize anything, an organization must document its practices, create repeatable systems, and most importantly, assign clear responsibilities. Someone must be appointed and held accountable for the outcome, otherwise, the effort risks becoming symbolic rather than effective. He concluded that in essence, building institutional reputation is about embedding values and processes into the system, ensuring they are not personality-driven but resilient and sustainable over time.

The Session had the following distinguished speaker:

Mr. Vishal Salvi

Chief Executive Officer

Quick Heal Technologies Ltd.

Mr. Salvi spoke about institutionalizing reputation by embedding it into an organization's culture, systems, and leadership conduct. He argued that reputation must be codified, not left to individual behaviour. At Quick Heal, this takes the form of a “Culture Code” that articulates zero tolerance for misconduct, expectations around accountability, and commitment to empowerment. Salvi emphasized that reputation is built by consistent small actions, not major events. Mumbai's inclusive dynamism provides a fertile ground for this philosophy. He stressed that leaders must remain authentic and consistent even as they rise in seniority. He concluded with the message that investing in people, ethics, and systems is the most effective strategy for reputation management in a volatile world.

The session concluded with a candid rapid-fire round, where Mr. Salvi reinforced that reputation is built through purpose-driven leadership, resilient systems, and ethical consistency, not just big decisions, but small, everyday choices.

Plenary Session VI:

Closing Address & Vote of Thanks

The 'Closing Address' was delivered by:

Ms. Priti Arora

Chief General Manager

Institute of Directors, Western Region

Ms. Arora concluded the enriching conference on reflecting on key insights. She highlighted that reputation is a strategic asset, not a by-product. Trust, ethical governance, and transparency emerged as central themes essential to long-term success. Reputation must be intentionally built, led from the top, and woven into organizational culture. It is what attracts investment, inspires confidence, and sustains institutions. She emphasized to lead with integrity, act with foresight, and remember that the legacy we leave is measured not just in outcomes but in trust. She extended her appreciation to all speakers, panellists, moderators, and participants for making the discussions impactful for future-ready organisations.

The 'Vote of Thanks' was proposed by:

Mr. Sharad Prabhu

Deputy Regional Manager

Institute of Directors, Western Region

Mr. Prabhu expressed gratitude to all speakers, delegates, and partners. He reflected on the collective commitment of industry leaders and regulators to fostering governance and growth through reputation. He emphasized to carry forward this momentum into boardrooms, institutions, and communities, as champions of reputation-led growth and governance.

IOD is especially grateful to its Event Partners of the Conference.

Our Platinum Partner: Union Bank of India

Our Strategic Partner: Neeraj Jha Brand and Reputation Advisory LLP

Our Venue Partner: BSE Limited

Our Silver Partners:

1. Saraswat Co-operative Bank Ltd.

2. National Commodity & Derivatives Exchange Limited (NCDEX)

3. ABM Knowledgeware Ltd.

Our Associate Partner: BoardPAC

Our Supporting Partner: The Institute of Company Secretaries of India (ICSI-WIRC)

This report is compiled by:

Western Region Team

Institute of Directors

&

Edited by: CS Sana Rehman

Executive Editor - Director Today

Institute of Directors

SUMMARY OF

RECOMMENDATIONS

MUMBAI REGIONAL CONFERENCE

1. Institutionalize Reputation as a Cultural Foundation

Reputation should not be treated as an afterthought or PR function it must be embedded in the organization's DNA. This involves codifying values through tools like a "Culture Code," aligning day-to-day behaviors with strategic goals, and ensuring that processes are built for long-term integrity, not short-term optics. True institutionalization means making ethical conduct repeatable, measurable, and scalable across all departments.

2. Empower Ethical and Value-Driven Leadership

Leadership must set the tone for organizational ethics. Reputational strength starts at the top with leaders who are transparent, accountable, and resilient in adversity. Whether in public service or corporate boardrooms, leaders must walk the talk, own their decisions, and embody the values they promote. Ethical leadership isn't a soft skill t's a strategic imperative that builds credibility and public trust.

3. Make Reputation Everyone's Responsibility

Reputation is co-created at every touchpoint from the boardroom to customer service desks. Every employee should be empowered to act with integrity and empathy. Organizations must reward behavior that enhances trust, not just financial results. When ethical behavior is consistently modeled and incentivized, it becomes a shared mission not a delegated duty to PR or compliance teams.

4. Build Trust Through Transparent and Predictable Regulation

Regulatory frameworks must strike a balance between oversight and enablement. SEBI and RBI were cited as models of consultative, transparent, and responsive regulation that fosters investor confidence. Predictable policies, clear enforcement, and open communication with stakeholders build long-term reputational resilience especially in the financial and capital markets.

5. Anchor Governance in Purpose, Prudence, and Accountability

Governance must move beyond ticking boxes and instead serve as a moral compass for the organization. Strong governance nurtures creativity, enhances service quality, and builds investor confidence. Purpose-driven boards and leadership teams grounded in prudence and accountability are more likely to deliver sustainable growth and institutional respect.

6. Foster Innovation That Serves the Customer Ethically In today's digital-first world, reputation hinges on how meaningfully businesses engage with customers. Innovation should not just be about speed or technology it must also ensure human connection, accessibility, and emotional resonance. Organizations must use tech to enable empathy, not diminish it, and must stay agile to meet rising customer expectations.

7. Apply the 'PPP' Model: People, Process, and Purpose

A strong reputation is built when:

• People (employees and leaders) consistently deliver on promises,

• Processes ensure reliability and trust, and

• Purpose provides a moral and strategic anchor.

All three pillars must work in tandem to create reputational momentum that endures beyond market cycles.

8. Prepare for Real-Time Reputational Risk in a Digital Era

Social media and digital platforms can elevate or destroy reputations within minutes. Organizations must be equipped to respond swiftly, own their missteps, and communicate transparently during crises. Boards and executives must treat reputational risk as a core agenda item and establish early warning systems to manage emerging threats proactively.

9. Strengthen Public Private Academic Collaborations

Reputation cannot be built in silos. Government bodies, regulators, corporates, and educational institutions must collaborate to foster ecosystem-wide excellence. These partnerships drive innovation, develop skilled talent, and elevate collective credibility essential for state-level branding, investment attraction, and global positioning.

10. Treat Reputation as a Strategic Asset on Par with Capital

Reputation must be valued and managed like any critical business asset. It influences investor decisions, stakeholder confidence, and organizational longevity. Boards should incorporate reputational metrics into performance reviews, strategic planning, and risk frameworks recognizing that reputation, like capital, compounds over time but can be lost in a moment.

Author

Institute of Directors India

Bringing a Silent Revolution through the Boardroom

Institute of Directors (IOD) is an apex national association of Corporate Directors under the India's 'Societies Registration Act XXI of 1860'. Currently it is associated with over 31,000 senior executives from Govt, PSU and Private organizations of India and abroad.

Owned by: Institute of Directors, India

Disclaimer: The opinions expressed in the articles/ stories are the personal opinions of the author. IOD/ Editor is not responsible for the accuracy, completeness, suitability, or validity of any information in those articles. The information, facts or opinions expressed in the articles/ speeches do not reflect the views of IOD/ Editor and IOD/ Editor does not assume any responsibility or liability for the same.

Quick Links

Quick Links

Connect us

Connect us

Back to Home

Back to Home