A Report on IOD Western Region Conclave-2025

The Institute of Directors (IOD), Western Region, convened the Mumbai Regional Conclave on October 10, 2025, at the National Stock Exchange (NSE), Bandra-Kurla Complex, Mumbai, welcoming an esteemed gathering of participants and industry leaders.

The theme, “Boardroom Finance and the Role of Independent Directors,” focused on the delicate balance between financial performance and ethical responsibility in corporate governance. The conclave provided a platform for thought leaders, governance professionals, and industry experts to exchange insights on how independent directors can guide organizations toward growth that is not only profitable but also principled and sustainable.

PLENARY SESSION - I

Boardroom Finance, Governance, and Investor Trust

The 'Opening Address' was delivered by:

Mr. Sitaram Kunte, IAS (Retd.)

Chairman

Institute of Directors (IOD), Western Region & Member Board of Governors, NISM

Mr. Kunte highlighted transparent and ethical decisionmaking as the cornerstone of Corporate Governance. He emphasized that trust is the most vital currency in business, particularly in times of digital disruption and economic uncertainty. He further underscored the importance of independent directors as objective voices who bring balance, integrity, and credibility to the boardroom discussions. He also stressed that today's boards must embrace digital awareness to analyze the large volumes of data, prevent manipulation, and manage cybersecurity risks. He encouraged the directors to adopt adaptability, foresight, and continuous improvement to help organizations thrive in a rapidly changing financial landscape. Mr. Kunte also lauded the collaboration between the NSE and IOD as a model partnership promoting governance excellence in India.

The 'Chief Guest' of the Event was:

Mr. Amarjeet Singh

Whole Time Member

Securities and Exchange Board of India (SEBI)

Mr. Singh emphasized the shift of Indian companies from purely commercial enterprises to Public-Interest Enterprises (PIEs), with an expanded focus on societal, environmental, and stakeholder responsibilities. He discussed the growing role of institutional investors and regulatory reforms that have strengthened accountability and engagement in boardrooms.

Mr. Singh further emphasized that good governance goes beyond compliance to include ethical culture, integrity, and transparency. He noted the challenges faced by independent directors, including resignations due to workload pressures, and warned of emerging risks such as greenwashing, AI washing, and purpose washing. He advocated for a shift from shareholder-centric to stakeholder-driven governance, stressing that boards must adopt holistic and sustainable strategies aligned with national development and social welfare.

The 'Guest of Honour' of the Event was:

Mr. Ashishkumar Chauhan

MD & CEO

National Stock Exchange of India Limited (NSE)

Mr. Chauhan focused on strengthening India's corporate and financial ecosystem through trust, transparency, accountability, and participation. He highlighted India's technological transformation, digital infrastructure, and financial inclusion, noting that over 235 million investor accounts reflect widespread confidence in the system. He also emphasized on India's model of “responsible capitalism,” where ethical responsibility accompanies ownership, creating a system of moral accountability. He stressed that governance is a moral duty as much as a regulatory requirement and encouraged businesses to combine innovation, ethics, and accountability to build enduring value.

This was followed by the 'Special Addresses' delivered by:

1. Prof. (Dr.) Rama Prosad Banerjee

Thought Leader, Author

Chairman & Director

EIILM-Kolkata

2. Ms. Sayali Bhoir

General Manager

Maharashtra State Co-operative Bank Ltd (MSCBL), & Former CEO and Secretary Maharashtra Urban Cooperative Banks Federation

3. Dr. Rajeev Uberoi

Chairman & Independent Director

Shalimar Paints

Prof. (Dr.) Banerjee underscored the role of non-executive directors in fostering trust, ethical oversight, and accountability. He emphasized the importance of comprehensive risk assessmentand strategic foresight, encouraging boards to adopt a holistic approach aligned with long-term corporate objectives. He cited exemplary governance models, such as the Tata Group, and encouraged other boards to integrate ethical leadership, stakeholder engagement, and value-driven decisionmaking to build sustainable organisations.

Ms. Bhoir highlighted the importance of trust, transparency, and independent oversight in co-operative banking. She emphasized balancing growth with stakeholder interests, especially post-pandemic, and integrating ESG principles, financial inclusion, and sustainable development into decision-making. Ms. Bhoir stressed that boards must combine strategic foresight with ethical values to ensure resilience, stability, and longterm value creation.

Dr. Uberoi focused hi delivery on financial transparency, ethical oversight, and the strategic role of independent directors. He emphasized that independent directors are crucial for safeguarding minority shareholder interests, managing conflicts, and guiding boards toward valuedriven, ethical decisions. Dr. Uberoi advocated for continuous knowledge updates, awareness programs, and proactive engagement to enhance board effectiveness. He concluded that strong corporate governance, built on trust, transparency, and accountability, aligns profitability with purpose and ensures sustainable organizational growth.

PLENARY SESSION - II

Special Talk

The 'Special Addresses' of the session were delivered by:

1. Ms.Unnati Bajpai

CEO & Principal Officer

Berkley Insurance Company, India

2. Mr. Kevin LaCroix

Executive Vice President

RT ProExec, USA

Ms. Bajpai delivered a forward-looking address on the theme, “Board Competency & Future Readiness” focusing on the evolving competencies required for modern boards, emphasizing that board effectiveness of competency extends far beyond compliance and financial oversight. She underscored the need for strategic vision, sectoral expertise, and technological fluency as key enablers of sound governance. Citing examples from Berkley Insurance and GIFT City, Gujarat, she illustrated how leveraging specialized networks and fostering a culture of continuous learning help boards anticipate risks and seize opportunities in complex domains such as marine insurance, cyber risk, and AI-driven insurance solutions. By adopting AI-powered predictive modeling and scenario planning, directors can make proactive, datadriven decisions while ensuring that such technologies are deployed ethically, transparently, and in full compliance with data privacy and trust standards. Stressing the strategic role of boards in risk oversight, she called for comprehensive insurance coverage frameworks that address emerging technology-related risks. Citing Deloitte projections that estimate AI-powered risk and insurance solutions to reach USD 4.7 billion globally by 2032, she reaffirmed the growing strategic importance of technology integration in governance. Concluding her address, Ms. Bajpai emphasized that empowering boards for informed and ethical decisionmaking requires regular training, independent oversight, and alignment of purpose with profit by ensuring growth that is responsible, resilient, and anchored in stakeholder trust.

Mr. LaCroix spoke on the theme: “Resilience & Future Readiness”, offering a global perspective on board resilience, risk management, and strategic governance, comparing practices across the U.S. and emerging markets. He noted that boards today operate in dynamic environments shaped by technological disruption, regulatory change, and increasing stakeholder expectations. Emphasizing effective board governance in today's complex, he highlighted the importance of structured reporting, accurate documentation, and clear accountability frameworks to ensure transparency and compliance. With the growing integration of AI and digital technologies, directors must understand the systems' limitations, assumptions, and biases while maintaining vigilant oversight to mitigate ethical, operational, and compliance risks. He underscored the need for boards to comprehend Directors' and Officers' (D&O) insurance, its coverage, triggers, and exclusions and to work closely with risk and legal experts on proactive mitigation and risk transfer strategies. Mr. LaCroix also outlined strategic imperatives for boards, emphasizing proactive oversight and scenario planning to anticipate and prepare for technological, operational, and market disruptions. He concluded that resilient, future-ready boards combine strong governance structures, active director involvement, comprehensive risk frameworks, and technological literacy to drive accountable, value-driven, and sustainable growth. His address underscored the importance of forward-looking governance in a rapidly evolving corporate landscape.

PLENARY SESSION - III

Accountable Leadership: Balancing Financial Vigilance with Personal Liability

The session was moderated by:

Mr. Narayan Shankar

former Executive Vice President & Company Secretary

Mahindra & Mahindra Ltd.

The session focused on the evolving responsibilities of independent directors (IDs) and non-executive directors (NEDs), emphasizing the balance between fiduciary duties, financial oversight, and personal accountability. Directors were recognized as key guardians of both organizational integrity and shareholder interests, required to comply with national and international regulations, including SEBI norms and global compliance frameworks.

Mr. Shankar stressed the importance of active engagement in board deliberations, challenging management assertions, independently verifying financial and operational data, and participating in robust risk assessments to avoid gaps in auditing, compliance, or reporting. Effective audit committees, transparent communication with management, and familiarity with D&O insurance frameworks were underscored as vital safeguards, illustrated by case studies such as Satyam Computers. In addition, technological disruption, cybersecurity threats, and ESG obligations were identified as growing challenges, necessitating scenario-based planning, thorough risk evaluation, and continuous learning, particularly in emerging markets. The session reinforced that accountable board leadership requires proactive participation, transparent documentation, and strategic oversight, enabling directors to uphold ethical governance, protect personal liability, strengthen organizational resilience, maintain stakeholder trust, and drive long-term value creation.

The session had the following distinguished speakers:

1. Mr. Shaymak Tata

Former Chairman

Deloitte & Independent Director on multiple boards

2. Mr. Mukund Chitale

Managing Partner

Mukund M. Chitale & Co.

3. Mr. Suresh Balakrishnan

Director

Novo Insurance Broking Services Pvt. Ltd., and Mentor, TransAsia Softech

Mr. Tata delivered an insightful address on governance, accountability, and stakeholder collaboration in corporate India. He highlighted that governance extends beyond compliance, requiring integrity, transparency, and shared purpose across management and boards. Independent directors should actively engage in board discussions, challenge assumptions, and continually update their knowledge to ensure effective oversight. Strong governance depends on healthy team dynamics, open dialogue, and robust whistle blowing mechanisms that uphold accountability. Boards must avoid blindly replicating Western models and instead cultivate India's unique governance identity, balancing regulatory compliance with strategic foresight. Leadership, as emphasized, is a collaborative journey where trust, ethical conduct, and a commitment to continuous improvement drive long-term institutional success. Mr. Tata emphasized that collective contribution outweighs individual brilliance, and true governance excellence emerges when boards function as a unified, responsible entity.

Mr. Chitale focused on moral courage, integrity, and accountability in financial leadership and corporate governance. Directors must have the conviction to say “no” when necessary, placing ethical decision-making above convenience or expediency. Auditing should be seen as a responsibility of trust, with accounting standards representing commitments to transparency rather than mere regulatory formalities. Independent directors are expected to integrate information, knowledge, and wisdom to make decisions that are both ethically sound and strategically relevant. Effective governance requires active participation, meticulous documentation of board minutes, and consistent engagement in whistleblowing, financial discipline, and ensuring fairness to all stakeholders. He concluded that corporate governance is as much about character as compliance; combining expertise with integrity ensures the organization's alignment with its mission, principles, and long-term sustainability.

Mr. Balakrishnan highlighted the evolving legal responsibilities of directors, particularly in insurance, risk management, and personal liability. Directors must recognize how operational decisions, claims processes, and risk distribution can impact their personal and organizational liability. D&O insurance serves as a crucial safeguard, with Side A coverage specifically protecting directors when the company is unable to indemnify them. Boards are expected to remain proactive in identifying risks, evaluating exposures, and coordinating preventive measures to mitigate potential threats. With emerging technological and regulatory risks, including cyber threats, directors must develop both technical literacy and strategic foresight to navigate complex and evolving governance landscapes effectively. He concluded that strong governance is a partnership between management, directors, and insurers, where understanding, quantifying, and managing risks responsibly ensures accountability, ethical conduct, and organizational resilience.

PLENARY SESSION - IV

Board Leadership in Innovation and Investor Trust: Lessons from Mutual Funds, Fintech, and NBFCs

The session was moderated by:

Mr. Amit Pandit

Independent Director

LIC Mutual Fund Trustee Co. Ltd.

Mr. Pandit explored how boards navigate innovation, investor trust, and governance in a digitally transparent, media-driven environment. he pointed that transparency, accountability, and authenticity have become nonnegotiable, requiring decisions to be timely, data-driven, and guided by ethical principles. Modern boards according to him are responsible for managing not only financial and operational risks but also technological, reputational, and cybersecurity challenges. He cited examples from sectors such as Mutual Funds, Fintech, and NBFCs, digitalization that presented both- major opportunities and potential vulnerabilities that boards must strategically navigate to maintain stability and growth. In this dynamic digital era he pointed that boards must cultivate digital literacy and strategic foresight to leverage technology effectively. This includes improving operational efficiency, enhancing stakeholder engagement, and mitigating emerging risks. Tools such as digital dashboards, AI-based audits, and datadriven decision-making frameworks further strengthen accountability, transparency, and overall governance effectiveness.

The session had the following distinguished speakers:

1. Mr. S. K. Dutt

Director, First Act Global Pvt. Ltd., and

Sr. Advisor, UNCTAD Empretec India Program

2. Mr. Sandeep Mantri

CFO

Protean eGov Technologies Limited

3. Mr. Sreeram Srinivasan

Director

Global Corp Logistics LLC, Oman

Mr. Dutt emphasized that trust forms the foundation of investor confidence, nurtured through consistent integrity, transparency, and strong governance practices over time. It highlighted the importance of ethical business conduct and strict regulatory compliance in enhancing organizational credibility. He emphasized on boards encouraging to foster innovation and adaptive leadership by leveraging team strengths and implementing forwardlooking strategies. His overarching message stressed that governance and innovation must go hand in hand to ensure sustainable and resilient organizational growth.

Mr. Mantri's discussion centered on trust, transparency, and open communication as fundamental pillars of sustainable corporate growth. It emphasized the need to integrate governance with innovation, ensuring that technology is adopted ethically and risks are managed proactively. Key areas such as cybersecurity, data protection, and stakeholder fairness were highlighted as essential components of modern governance. He concluded with the reminder that trust is earned gradually through consistent, ethical, and transparent actions by the board and leadership.

Mr. Srinivasan's discussion focused on modernization, technology, and strong governance as key drivers of industrial growth and long-term sustainability. It emphasized the importance of addressing fragmented markets and supply-demand imbalances through digital tracking tools and efficient policy implementation. Additionally, he advocated for data-driven governance and robust monitoring systems to ensure sustainable growth, operational transparency, and effective decisionmaking.

PLENARY SESSION - V

Transformative Technologies and Financial Governance: The Expanding Role of Independent Directors

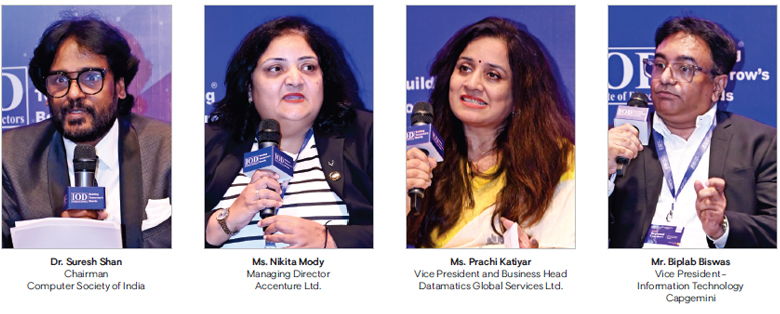

The Moderator of the session was:

Dr. Suresh Shan

Chairman

Computer Society of India

The session had the following distinguished speakers:

1. Ms. Nikita Mody

Managing Director

Accenture Ltd.

2. Ms. Prachi Katiyar

VP & Business Head

Datamatics Global Services Ltd.

3. Mr. Biplab Biswas

Vice President

Information Technology

Capgemini

Dr. Shan in the session explored how independent directors can integrate transformative technologies, AI, and digital tools into governance, risk management, and compliance frameworks. Technology according to her has become a central element of modern governance, shaping transparency, accountability, and sustainability. While intelligent systems and automation offer significant opportunities, Dr. Suresh pointed out on the risks they introduce, such as cybersecurity threats and ethical dilemmas. Independent directors according to her play a critical role in overseeing technological adoption, ensuring the ethical use of AI, and aligning initiatives with sustainability goals. By embracing proactive and adaptable governance, she says that boards can enhance organizational resilience, support long-term growth, and maintain the trust of stakeholders.

Ms. Mody highlighted the critical importance of trust, data privacy, and security in the adoption of new technologies. She emphasized the need for directors to exercise situational intelligence and agility when navigating rapid technological changes. Additionally, she advocated for ethical and strategic oversight of technology to ensure alignment with the organization's long-term goals and sustainable growth.

Ms. Katiyar focused the discussion on evaluating the relevance of technology, ensuring its strategic adoption, and aligning initiatives with compliance requirements. Boards were encouraged to foster internal innovation and support startup initiatives to remain agile and forwardlooking. She also highlighted the vital intersection of governance, technology, and value creation as a key driver for sustainable organizational growth.

Mr. Biswas's discussion emphasized on technology as a strategic enabler for governance, risk management, and operational efficiency. It advocated for the incremental adoption of technology to minimize risks while delivering tangible, measurable impact. Additionally, he highlighted technology's crucial role in enhancing cybersecurity, strengthening accountability, and driving measurable organizational outcomes.

The Event concluded with a 'Vote of Thanks' proposed by:

Ms. Priti Rao Arora

Chief General Manager

Institute of Directors (IOD)

Western Region

Ms. Arora concluded the conclave by acknowledging the valuable contributions of speakers, moderators, and participants. She highlighted that ethical governance, transparency, and informed decision-making are central to effective boardroom leadership. Boards must strike a balance between financial acumen, technological awareness, and active stakeholder engagement. Resilient organizations are built when governance integrates operational efficiency, innovation, and sustainability. The conclave underscored the importance of purpose-driven performance, trust, and continuous learning as essential qualities for independent directors.

The session concluded with heartfelt appreciation to everyone who contributed to its success.

Special thanks and gratitude were expressed to Partners:

GOLD Partners:

1. Novo Insurance Banking Services Pvt. Ltd.

2. TransAsia Soft Tech

BRONZE Partner:

The Maharashtra State Co-op. Bank Ltd.

VENUE Partner:

National Stock Exchange of India Limited (NSE)

This report is compiled by:

Institute of Directors (IOD)

Western Region

Author

Institute of Directors India

Bringing a Silent Revolution through the Boardroom

Institute of Directors (IOD) is an apex national association of Corporate Directors under the India's 'Societies Registration Act XXI of 1860'. Currently it is associated with over 31,000 senior executives from Govt, PSU and Private organizations of India and abroad.

Owned by: Institute of Directors, India

Disclaimer: The opinions expressed in the articles/ stories are the personal opinions of the author. IOD/ Editor is not responsible for the accuracy, completeness, suitability, or validity of any information in those articles. The information, facts or opinions expressed in the articles/ speeches do not reflect the views of IOD/ Editor and IOD/ Editor does not assume any responsibility or liability for the same.

Quick Links

Quick Links

Connect us

Connect us

Back to Home

Back to Home