Latest from the Regulator - September 2025

1. MCA seeks stakeholder inputs on creating Multi Disciplinary Partnership (MDP) firms

• The Ministry of Corporate Affairs has constituted an Inter- Ministerial Group (IMG) on developing the domestic ecosystem of consulting and auditing firms under the Chairpersonship of the MCA Secretary.

• The ministry is seeking stakeholder comments on establishing Multi-Disciplinary Partnership (MDP) firms, allowing professionals like Chartered Accountants, Lawyers, and actuaries to collaborate under one structure. This initiative aims to foster the growth of large, competitive Indian firms capable of capturing a larger share of the global auditing and consultancy market, currently dominated by international players.

• The ministry has put out a background note that details current rules and regulations. It wants the stakeholders to identify the challenges faced by Indian firms and submit their suggestions for necessary amendments to laws, rules, and regulations.

• The ministry has asked stakeholders to submit their comments on the issue by September 30.

• The ministry also suggested to review the requirement of “majority of partners” referred to in proviso to Section 141(1) of the Companies Act, 2013 is under consideration.

2. SEBI mandates appointment of Two Executive Directors on board of Market Infrastructure Institutions

• The Securities and Exchange Board of India (SEBI) has issued governance norms for Market Infrastructure Institutions (MIIs), mandating the appointment of two executive directors (EDs) on their governing boards.

• Under the new guidelines, MIIs are required to prioritise critical operations, regulatory compliance, risk management, and investor grievance redressal over commercial interests.

• SEBI's guidelines seek to ensure that MIIs maintain robust governance structures and that top management roles are clearly defined to safeguard regulatory and operational standards.

3. MCA expands Fast Track Merger Framework to enable more Startup Reverse Flips

• MCA has widened the scope of fast-track mergers, allowing more companies to restructure without seeking approval from the National Company Law Tribunal (NCLT).

• New exemptions include mergers of unlisted firms under INR 200 Cr debt, foreign holding companies with Indian subsidiaries, and intra-group subsidiaries of the same parent.

• The move is expected to accelerate reverse flipping, as startups with overseas holding structures get a smoother path to re-domicile in India ahead of IPOs

4. Amendments to SEBI Listing Regulations and Circulars to Facilitate Ease of Doing Business in Related Party Transactions (RPT)

The amendments are aimed to address practical challenges and remove ambiguities and strike a balance between investor protection and ease of doing business, with respect to the Related Party Transaction (RPT) framework under SEBI LODR Regulations, 2015.

The amendments include:

a. Introduction of scale-based thresholds based on annual consolidated turnover of the listed entity, for determining material RPTs

b. Revised thresholds for approval by Audit Committee, for RPTs undertaken by subsidiaries

c. Simpler disclosure requirements for smaller RPTs

d. Provisions pertaining to validity periods of omnibus approval by shareholders as contained in the Master Circular on LODR, to be incorporating in the LODR

e. Clarification with regard to exemption pertaining to retail purchases undertaken by listed entity or its subsidiary with its Directors or Key Managerial Personnel or their relatives; and

f. Clarification that the term “holding company” always referred to “listed holding company”.

To introduce scale-based threshold considering the annual consolidated turnover of the listed entity as per last audited financial statements, for determining material Related Party Transactions (“RPTs”) for approval by shareholders as under:

| Existing Threshold | Revised Scale-based Threshold | |

| Rupees one thousand crore or ten per cent of the annual consolidated turnover of the listed entity as per the last audited financial statements of the listed entity, whichever is lower. | Annual Consolidated Turnover of Listed Entity | Threshold |

| (I) Up to Rs. 20,000 Crore | 10% of the annual consolidated turnover of the listed entity |

|

| (II) More than Rs. 20, 001 Crore to up to Rs. 40,000 Crore |

Rs. 2,000 Crore + 5% of the annual consolidated turnover of the listed entity above Rs. 20,000 Crore |

|

| (III) More than Rs. 40,000 Crore |

Rs.3,000 Crore + 2.5% of the annual consolidated turnover of the listed entity above Rs.40,000 Crore or Rs. 5000 Crore, whichever is lower. |

|

5. SEBI allows large firms to launch IPOs with smaller issue size

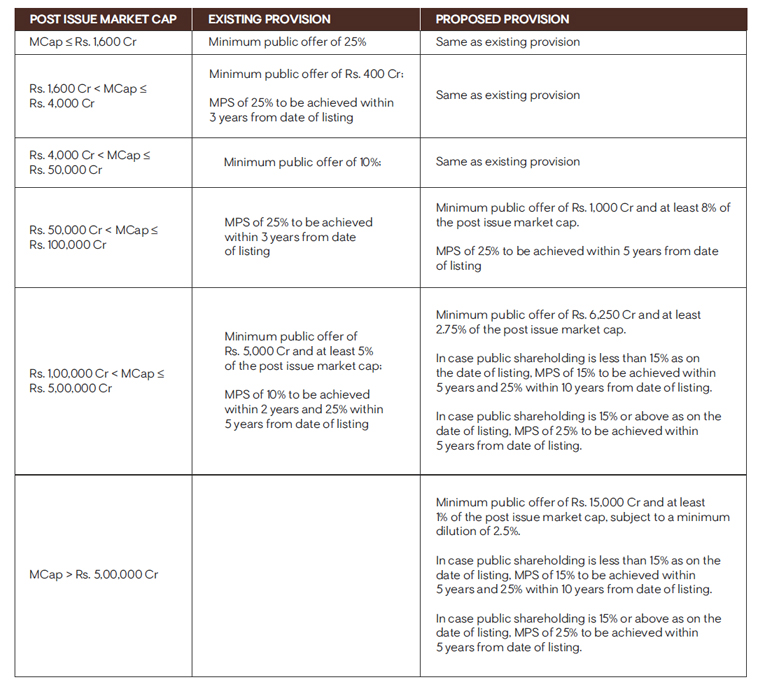

The SEBI said that companies can now sell a minimum of 2.5% of their paid-up share capital in their IPO from the current 5% if their market capitalization is above Rs 5 lakh crore after the listing. This will make it easier for the market to absorb the sizeable offerings.

For companies with market cap between Rs. 50,000 crore- Rs. 1 lakh crore, the Minimum Public Shareholding (MPS) of 25% is to be achieved in 5 years as against current 3 years.

SEBI also relaxed the deadline for large companies to meet the 25% public float requirement to five years from three years.

For more details, visit: https://www.sebi.gov.in/media-and-notifications/press-releases/sep-2025/sebi-board-meeting_96601.html

Author

Institute of Directors India

Bringing a Silent Revolution through the Boardroom

Institute of Directors (IOD) is an apex national association of Corporate Directors under the India's 'Societies Registration Act XXI of 1860'. Currently it is associated with over 31,000 senior executives from Govt, PSU and Private organizations of India and abroad.

Owned by: Institute of Directors, India

Disclaimer: The opinions expressed in the articles/ stories are the personal opinions of the author. IOD/ Editor is not responsible for the accuracy, completeness, suitability, or validity of any information in those articles. The information, facts or opinions expressed in the articles/ speeches do not reflect the views of IOD/ Editor and IOD/ Editor does not assume any responsibility or liability for the same.

Quick Links

Quick Links

Connect us

Connect us

Back to Home

Back to Home