The Governance Quadrant of Control: A Framework for Institutional Wisdom

Board Structures Reimagined

Board structures vary across jurisdictions and industries, with single-tier and dual-tier models shaping governance differently. Dual board structures, common in Europe, separate management and oversight, while Anglo-American single boards integrate both. Each structure carries vulnerabilities such as concentration of power in tech firms or stakeholder conflicts in financial institutions that demands tailored governance responses.

Board Structures and Governance: Introduction

Corporate governance is the architecture through which organizations balance accountability, transparency, and strategic direction. At its core lies the board of directors, the body entrusted with oversight, risk management, and stewardship of shareholder and stakeholder interests. Yet, board structures differ significantly across geographies and industries, reflecting cultural, legal, and economic contexts.

This narrative explores:

• Types of board structures

• Dual board structures and their strategic significance.

• Structural vulnerabilities across industries.

• Industry significance -Examples from technology, finance, manufacturing, and healthcare to illustrate governance implications.

• Quadrant Framework for Board Structures

• Decoding board structures through governance quadrant framework.

Types of Board Structures

i. Single-Tier (Unitary) Board

• Definition: A single board integrates executive directors (management) and non-executive directors (oversight).

• Prevalence: Dominant in Anglo-American jurisdictions (US, UK, India).

• Strengths:

o Faster decision-making.

o Unified accountability.

o Easier coordination between strategy and oversight.

• Weaknesses:

o Risk of management dominance.

o Potential conflicts of interest.

Example:

• Apple Inc. (US): Combines executive leadership (CEO Tim Cook) with independent directors. This structure supports rapid innovation but requires strong independent voices to counterbalance executive influence.

ii. Dual-Tier (Two-Tier) Board

• Definition: Separation of powers between a management board (executive operations) and a supervisory board (oversight, appointments, major approvals).

• Prevalence: Civil law jurisdictions (Germany, Netherlands, Austria).

• Strengths:

o Clear separation of management and oversight.

o Enhanced accountability and transparency.

o Employee representation (codetermination in Germany).

• Weaknesses:

o Slower decision-making.

o Risk of supervisory board detachment from operational realities.

Example:

• Volkswagen AG (Germany): Supervisory board includes labor representatives, balancing shareholder and employee interests. This codetermination model strengthens stakeholder trust but can slow crisis responses (e.g., emissions scandal).

iii. Hybrid Models

• Japan: Boards often include statutory auditors alongside directors, blending oversight with advisory roles.

• Emerging Economies: Hybrid structures evolve to balance global investor expectations with local stakeholder traditions.

Dual Board Structures: Strategic Significance

Dual boards are designed to reduce conflicts of interest by separating execution from oversight.

• Management Board: Handles day-to-day operations, strategy implementation, and executive leadership.

• Supervisory Board: Appoints management, approves major decisions, monitors performance, and represents stakeholders.

Strategic Benefits:

• Transparency: Clear accountability lines.

• Stakeholder Balance: Employee and shareholder voices coexist.

• Long-Term Orientation: Supervisory boards often prioritize sustainability over short-term profits.

Case Study:

• Siemens AG (Germany): Dual board structure enabled long-term investment in renewable energy, balancing shareholder returns with sustainability imperatives.

Structural Vulnerabilities Across Industries

i. Technology Industry

• Vulnerability: Concentration of power in founder-led boards.

• Example: Meta Platforms (Facebook) - Mark Zuckerberg’s dual-class shareholding limits board independence.

• Significance: Innovation thrives, but governance risks include unchecked executive power and weak accountability.

ii. Aviation and Financial Services

• Vulnerability: Complex risk oversight.

• Example: Lehman Brothers (2008 collapse) - Single-tier board failed to challenge excessive risk-taking. Inter-globe aviation Ltd failed to follow regulatory updates and challenging systemic crisis.

• Significance: Highlights need for specialized risk committees and independent directors with financial expertise.

iii. Manufacturing & Automotive

• Vulnerability: Stakeholder conflicts in dual boards.

• Example: Volkswagen - Supervisory board’s labor representation slowed decisive action during emissions crisis.

• Significance: Codetermination strengthens legitimacy but may hinder agility in crises.

iv. Healthcare & Pharmaceuticals

• Vulnerability: Ethical oversight and compliance.

• Example: Johnson & Johnson - Single-tier board faced scrutiny during opioid litigation.

• Significance: Boards must integrate ethics committees and external advisors to safeguard reputation.

Comparative Table of Board Structures

| Model | Jurisdictions | Strengths | Weaknesses | Industry Example |

| Single-Tier | US, UK, India | Fast decisions, unified accountability | Risk of executive dominance | Apple, J&J |

| Dual-Tier | Germany, Netherlands | Separation of powers, stakeholder balance | Slower decisions, detachment risk | Volkswagen, Siemens |

| Hybrid | Japan, Emerging Economies | Flexibility, cultural fit | Ambiguity in roles | Toyota, Tata Group |

Industry Significance and Lessons

• Technology: Boards must counterbalance founder dominance with independent directors and governance safeguards.

• Finance & Aviation: Risk committees and regulatory oversight are critical to prevent systemic crises.

• Manufacturing & Automotive: Codetermination enhances legitimacy but requires agility mechanisms.

• Healthcare: Ethical oversight is paramount to sustain trust and compliance.

Gravitas

Board structures are not one-size-fits-all. Single-tier boards excel in agility but risk executive dominance. Dual-tier boards strengthen accountability but may slow responsiveness. Hybrid models adapt governance to cultural and economic contexts. The structural vulnerabilities across industries underscore the need for tailored governance frameworks:

• Tech firms must mitigate founder dominance.

• Aviation & Financial institutions must prioritize risk oversight.

• Manufacturers must balance stakeholder representation with agility.

• Healthcare boards must institutionalize ethical safeguards.

Ultimately, effective governance lies not in the structure alone but in the quality of board culture, independence, and strategic foresight.

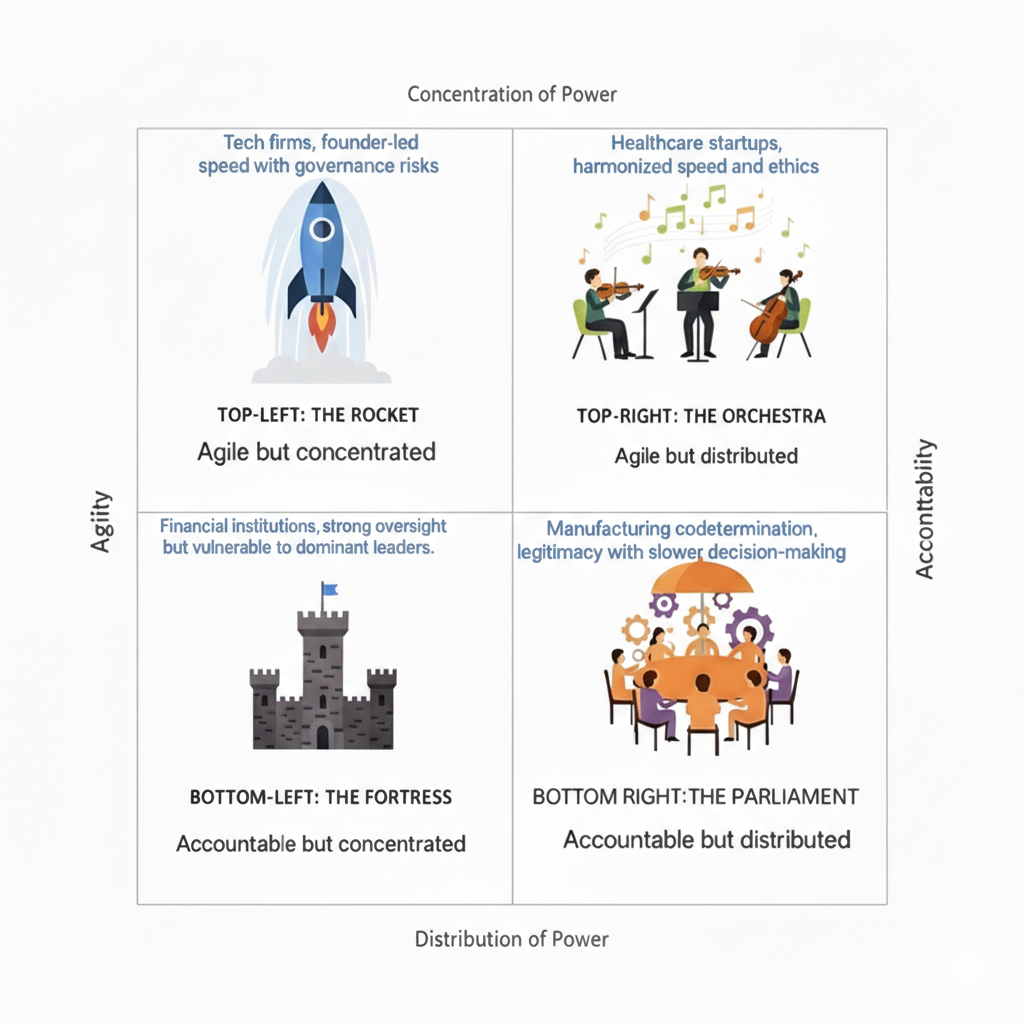

Quadrant Framework for Board Structures

The framework interpretation: Quadrant Axes

• X-Axis: Agility ↔ Accountability

- Agility: Speed of decision-making, adaptability, innovation.

- Accountability: Oversight strength, stakeholder trust, compliance rigor.

• Y-Axis: Concentration of Power ↔ Distribution of Power

- Concentration: Founder-led dominance, executive-heavy boards.

- Distribution: Balanced representation, codetermination, independent oversight.

The Four Quadrants

| Quadrant | Label | Characteristics | Industry Examples | Governance Significance |

| Top-Left | Agile but Concentrated | Fast-moving, founder-driven, limited oversight | Tech firms (Meta, Tesla) | Innovation thrives, but risk of unchecked executive power |

| Top-Right | Agile and Distributed | Fast decisions with balanced oversight | Healthcare startups with strong ethics boards | Combines speed with trust; ideal for sensitive industries |

| Bottom-Left | Accountable but Concentrated | Strong oversight but power clustered | Financial institutions with dominant executives | Risk committees exist, but may fail if leadership dominates |

| Bottom-Right | Accountable and Distributed | Dual boards, codetermination, stakeholder balance | Volkswagen, Siemens | High legitimacy, but slower crisis response |

This framework is designed for boardroom clarity. This refined quadrant is both visual and metaphorical.

Metaphorical Anchors

To make the framework memorable in boardrooms, use metaphors:

• Agile but Concentrated → “The Rocket”

o Fast launch, but risk of explosion if unchecked.

• Agile and Distributed → “The Orchestra”

o Harmonized speed and balance, multiple instruments aligned.

• Accountable but Concentrated → “The Fortress”

o Strong walls, but vulnerable if the gatekeeper falters.

• Accountable and Distributed → “The Parliament”

o Inclusive, legitimate, but deliberative and slower.

Decoding Board Structures Through Governance Quadrants

“In today’s volatile landscape, governance isn’t just a compliance function - it’s a strategic differentiator. To navigate complexity, boards must understand not only their structure but their posture: how power is distributed, how decisions are made, and how agility balances with accountability.”

Introducing the Quadrant

“This quadrant framework maps board structures across two critical axes:

• Agility vs. Accountability - the speed of decision-making versus the depth of oversight.

• Concentration vs. Distribution of Power - the locus of control, from founder-led dominance to stakeholder-inclusive governance.”

Quadrant 1: The Rocket

Agile but Concentrated

“Tech firms like Meta and Tesla exemplify this quadrant. Founder-led boards move fast, innovate boldly, and often disrupt entire industries. But rockets, while powerful, are volatile. Without governance safeguards, they risk ethical lapses, reputational damage, or strategic blind spots.”

Boardroom Insight:

“Introduce independent directors, ethics committees, and scenario planning to temper speed with foresight.”

Quadrant 2: The Orchestra

Agile and Distributed

“Healthcare startups with strong ethics boards operate here. Like an orchestra, they harmonize speed with stakeholder trust. Decisions are swift, yet inclusive - ideal for industries where lives, not just profits, are at stake.”

Boardroom Insight:

“Embed cross-functional advisory boards and patient advocacy voices to sustain ethical agility.”

Quadrant 3: The Fortress

Accountable but Concentrated

“Aviation industry and Financial institutions often fall into this quadrant. Oversight is robust - risk committees, regulatory compliance, audit trails. Yet when power is concentrated in dominant executives, the fortress can falter from within, as seen in the 2008 crisis and recent Inter-Globe Aviation Ltd (IndiGo)crisis.

Boardroom Insight:

“Strengthen whistleblower channels, rotate committee chairs, and diversify board composition to prevent insular thinking.”

Quadrant 4: The Parliament

Accountable and Distributed

“Manufacturing giants like Volkswagen and Siemens embody this quadrant. Dual boards, codetermination, and stakeholder representation create legitimacy and long-term orientation. But like any parliament, deliberation can slow crisis response.”

Boardroom Insight:

“Build agile subcommittees and empower crisis task forces to complement deliberative governance.”

Reflection

The Governance Quadrant is not just a diagnostic tool but a strategic lens. Boards must ask:

• Where do we sit today?

• Where should we evolve to meet tomorrow's risks and opportunities?

• How do we institutionalize wisdom without sacrificing responsiveness?

The Governance Quadrant as a Strategic Lens

Governance today is far more than a compliance exercise; it is a strategic differentiator that shapes resilience, legitimacy, and foresight. The Governance Quadrant reframes board structures not as static models but as dynamic postures. By mapping agility against accountability, and concentration of power against distribution, boards gain a powerful lens to interrogate their current state and chart their evolution.

1. Where do we sit today?

Boards must begin with candid self-assessment. Are they operating as a Rocket-fast, founder-led, but vulnerable to unchecked authority? Or as a Parliament-legitimate and inclusive, yet slow to respond in crises? This diagnostic step demands transparency about decision-making speed, oversight depth, and the balance of voices at the table. Without clarity on current posture, strategic adaptation remains elusive.

2. Where should we evolve to meet tomorrow's risks and opportunities?

The Quadrant is inherently forward-looking. A Fortress board may need to evolve toward the Orchestra, embedding distributed oversight to navigate ethical challenges in sensitive industries. Conversely, a Rocket may need to temper speed with accountability to avoid reputational damage. Evolution is not about abandoning strengths but recalibrating them to align with emerging risks—cybersecurity, climate change, geopolitical volatility-and opportunities such as digital transformation or stakeholder capitalism.

3. How do we institutionalize wisdom without sacrificing responsiveness?

Wisdom in governance lies in balancing foresight with agility. Institutionalizing wisdom means embedding practices-independent directors, ethics committees, scenario planning, stakeholder engagement-that ensure decisions are both principled and timely. Responsiveness must remain intact, but guided by structures that prevent impulsive or insular choices.

Strategic Implications

- Directors: A mirror revealing blind spots in oversight.

- Founders: A caution against concentrated power, offering pathways to balance entrepreneurial speed with trust.

- Investors: A due diligence tool signaling resilience and long-term value.

- Stakeholders: Assurance that governance is strategically positioned to safeguard diverse interests.

Quadrant Metaphors for Boardroom Clarity

• The Rocket (Agile but Concentrated): Fast launch, but risk of explosion if unchecked.

• The Orchestra (Agile and Distributed): Harmonized speed and balance, multiple instruments aligned.

• The Fortress (Accountable but Concentrated): Strong walls, but vulnerable if the gatekeeper falters.

• The Parliament (Accountable and Distributed): Inclusive, legitimate, but deliberative and slower.

These metaphors make the framework memorable and actionable in boardroom discussions.

Application in Industries

• Technology (Rocket): Founder-led agility, but governance safeguards needed.

• Healthcare (Orchestra): Ethical oversight with speed ensures trust in sensitive decisions.

• Finance & Aviation (Fortress): Oversight structures exist, but concentrated leadership can undermine resilience.

• Manufacturing (Parliament): Codetermination builds legitimacy, but agility mechanisms must be added for crises.

Boardroom Recommendations

1. Self-Assessment: Use the Quadrant to map current posture.

2. Scenario Planning: Identify risks and opportunities that demand structural evolution.

3. Governance Safeguards: Institutionalize ethics committees, independent oversight, and stakeholder engagement.

4. Agility Mechanisms: Build subcommittees and task forces to complement deliberative governance.

5. Continuous Evolution: Treat governance as a living system, adapting to external shocks and internal dynamics.

Closing Perspective

The Governance Quadrant reframes board structures as dynamic postures of stewardship—balancing agility, accountability, and legitimacy. From rockets of innovation to fortresses of oversight, orchestras of ethical agility to parliaments of legitimacy, excellence lies in boards that fluidly shift across quadrants. In doing so, they transcend compliance, becoming stewards of enduring impact and foresight

References

Comparative Analysis of Corporate Governance Models Across Major

A Dual Board Structure’s Strategic Benefit for Corporate Governance:

https://techzoid.org/a-dual-board-structures-strategic-benefit-for-corporate-governance/

Dual board:

Author

Ms. Shaluu Bharddwaj

Director - Kingpin Kaiser Preneurs Pvt. Ltd., and Board Advisor on Multiple Boards

Owned by: Institute of Directors, India

Disclaimer: The opinions expressed in the articles/ stories are the personal opinions of the author. IOD/ Editor is not responsible for the accuracy, completeness, suitability, or validity of any information in those articles. The information, facts or opinions expressed in the articles/ speeches do not reflect the views of IOD/ Editor and IOD/ Editor does not assume any responsibility or liability for the same.

Quick Links

Quick Links

Connect us

Connect us

Back to Home

Back to Home