From Gut Feel to Governance: Institutionalizing Risk Appetite in the Indian Boardroom

The Independent Director's Role in Building a Risk-Informed Culture

Introduction: The Case for Change

Traditionally, many Indian companies relied on promoter instinct and legacy practices for strategic decisions; an approach that worked in stable times but falters in today's volatile world. Geopolitical shocks, regulatory scrutiny, climate risks, and digital disruption have made gut-based governance a dangerous gamble, exposing firms to blind spots and existential threats.

In this new reality, Independent Directors cannot remain ceremonial overseers. They must evolve into strategic guardians; challenging assumptions, probing risk boundaries, and embedding discipline into decision-making. By institutionalizing risk appetite frameworks, directors can shift risk from a reactive hazard to a strategic advantage, aligning ambition with accountability. Done well, this equips boards to face uncertainty not with fear, but with foresight.

Defining Risk Appetite: The Boardroom's Strategic Compass

At its core, risk appetite is the strategic compass that guides a company's willingness to take on risk in pursuit of its objectives. It is not merely a technical or regulatory concept; it is the governance boundary between bold ambition and reckless exposure. When clearly defined and actively monitored, risk appetite ensures that decision-makers pursue growth with discipline, take calculated risks with clarity, and reject temptations that exceed the company's capacity or violate its values.

What is Risk Appetite:

“Risk appetite is the amount of risk, on a board level, an organization is willing to accept in pursuit of value. Each organization pursues various objectives to add value and should broadly undertake the risk it is willing to undertake in doing so.”

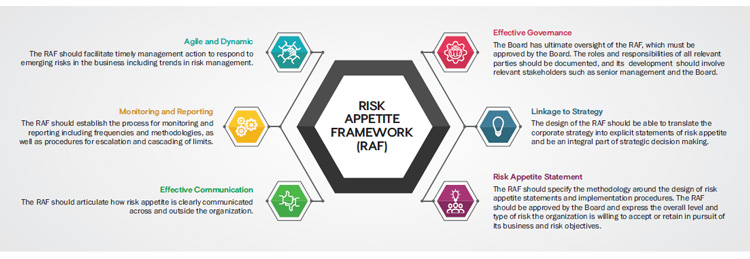

Understanding the Risk Appetite Framework: Turning Strategy into Structured Risk

A Risk Appetite Framework (RAF) is a structured, board driven approach that defines how much risk an organization is willing and able to take in pursuit of its strategic goals. It aligns risk-taking with business strategy, governance standards, and stakeholder expectations. Far more than a compliance tool, the RAF serves as a strategic guardrail, helping boards especially Independent Directors to ensure that risks are not taken by default, but by design. It transforms risk from a vague concern into a measurable, monitored, and managed discipline at the heart of corporate decision-making.

A clear risk appetite is the lantern in the fog illuminating the path where ambition meets “caution.”

| Term | Definition | Boardroom Example for Independent Directors |

| Risk Appetite | The type and level of risk the company is willing to accept in pursuit of its strategic goals. |

“We are willing to take moderate credit risk to grow our SME lending portfolio.” |

| Risk Tolerance | The acceptable variation around appetite; specific thresholds that trigger concern or corrective action. | “We tolerate a Gross Non-Performing Assets (GNPA) of up to 4%. Breach above that triggers board review.” |

| Risk Capacity | The maximum risk the company can handle, based on financial, human, or operational strength. | “With only Rs.50 crore in surplus liquidity, we cannot absorb a major asset write-down.” |

| Risk Limits | Day-to-day operating thresholds set within business functions to stay within tolerance. | “No single loan over Rs.10 crore without CRO approval.” |

Key Components of Risk Appetite

Risk appetite is only effective when it is clearly defined, measured, and monitored. Its key components transform risk from an abstract concern into a structured, board-driven discipline. Here's an overview of its key components:

Why Risk Appetite Matters for Independent Directors

For Independent Directors, risk appetite is not just a governance tool it is a fiduciary safeguard. It empowers them to ensure that risk-taking is aligned with the company's values, strategy, and capacity. In the absence of a clear risk appetite framework, boards are left navigating blind exposing the company to either uncalculated risk or missed opportunity.

Without defined boundaries, oversight becomes reactive, and accountability gets blurred.

A well-structured risk appetite allows Independent Directors to:

• Challenge unchecked ambition by asking: "Is this risk within our declared appetite?"

• Guard against complacency by questioning: "Are we under-leveraging strategic opportunities?"

• Drive a culture of informed risk-taking, not avoidance or recklessness.

The Indian Reality: Risk Appetite as an Afterthought

Despite growing regulatory emphasis, risk appetite remains an underdeveloped and often misunderstood concept across Indian boardrooms. For many companies, it is still treated as a compliance formality if acknowledged at all rather than a strategic governance tool. Critical decisions involving capital deployment, market expansion, or debt accumulation are frequently taken without clear boundaries on what level of risk is acceptable or sustainable.

| REAL-WORLD LESSONS FROM INDIA INC.: A COMPARATIVE RISK APPETITE LENS | ||||

| Company | Risk Type Breached | Risk Appetite Failure | Board Oversight Gap | Outcome |

| IL&FS | Leverage & Liquidity Risk | No defined appetite for debt accumulation or inter-company exposure | Failed to question sustainability of expansion and debt servicing | Default and systemic NBFC crisis (2018) |

| Yes Bank | Credit Risk | Aggressive lending far beyond prudent risk appetite; weak exposure controls | Inadequate challenge to high-risk asset growth; delayed recognition of deteriorating loans | RBI takeover and reputational damage (2020) |

| Vodafone Idea | Financial & Regulatory Risk | No clarity on appetite for litigation exposure or erosion of net worth | Passive approach to capital raising and risk disclosure | Prolonged financial distress and market erosion |

| Satyam Computers | Reputational & Fraud Risk | Ethical risk appetite breached; no clear boundary for governance or disclosure practices | Board accepted manipulated financials at face value | Corporate scandal and takeover by Tech Mahindra (2009) |

| DHFL | Credit Concentration & Fraud |

Excessive exposure to related-party and high-risk borrowers; risk culture ignored | Independent directors missed red flags in audit and disclosures | Default, promoter arrest, and resolution via NCLT (2020) |

“In the absence of a defined risk appetite, every bold move feels justifiable until it becomes indefensible.”

Building the Framework: Core Components

A well-defined risk appetite is only as effective as the framework that supports it. By establishing clear components ranging from strategic statements to operational controls organizations can translate risk intent into structured action. For Independent Directors, these components serve as essential tools to ensure that risk is not just taken, but governed with discipline, transparency, and foresight.

| COMPONENT | PURPOSE | BOARD-LEVEL SIGNIFICANCE | EXAMPLE |

| Risk Appetite Statement (RAS) | Articulates acceptable levels of risk across categories (e.g., financial, reputational, operational). | Aligns strategy with governance boundaries; provides oversight clarity. | “We have low appetite for compliance risk but moderate appetite for innovation risk.” |

| Quantitative Metrics | Defines measurable thresholds and ratios to monitor risk-taking behavior. | Enables objective tracking, early warnings, and evidence-based decisions. | Max Debt/Equity Ratio ≤ 1.5x; NPA ≤ 4%; ROE target ≥ 12% |

| Qualitative Guidelines | Sets boundaries on conduct, ethics, and stakeholder sensitivities. | Reinforces culture, values, and non-negotiables for Independent Directors. | Zero tolerance for regulatory non-compliance or reputational harm. |

| Monitoring & Reporting Tools | Tracks adherence to appetite and flags breaches. | Equips directors with timely visibility into risk alignment or violations. | Risk dashboards, quarterly appetite deviation reports, board escalation logs |

| Escalation Protocols | Outlines steps when thresholds are breached—who acts, how fast, and with what authority. | Ensures accountability and responsiveness; protects against passive oversight. | Breach of risk tolerance triggers Risk Committee review within 7 days. |

Risk Appetite Implementation Roadmap for Independent Directors

Turning risk appetite from theory into boardroom practice requires more than approval, it demands disciplined execution. Independent Directors play a pivotal role in this journey by driving alignment, embedding risk thinking into strategic decisions, and insisting on clear metrics, reporting, and escalation protocols. A well-structured implementation roadmap empowers the board to govern risk not by instinct, but by informed intent.

Reminder to Independent directors Risk appetite is not about saying no to risk - it's about knowing when, why, and how to say yes.”

Conclusion: From Instinct to Intention - The Governance Imperative

The age of gut-driven governance is over. In an era defined by volatility, complexity, and accountability, Indian boardrooms must shift from intuition to intention - anchored by a clear and credible risk appetite framework. For Independent Directors, this is not a passive compliance exercise - it is a strategic leadership opportunity. By championing risk appetite, they help the board move beyond firefighting and hindsight to forwardlooking, risk-informed decision-making. They ensure that ambition is disciplined, innovation is safeguarded, and resilience is not left to chance.

“When risk appetite is clearly defined and actively governed, the boardroom becomes not just a seat of power - but a shield of purpose.”

The time to act is now. India's economic ambitions deserve a governance culture that treats risk not as a threat - but as a language, a compass, and a responsibility. Independent Directors must be its fluent speakers and steadfast custodians.

Author

Dr. Tania Dehury

He is a seasoned leader with over 20 years of experience in Enterprise Risk Management (ERM) and Environmental, Social, and Governance (ESG) Strategy. He currently serves as the Head of Risk and Business Continuity at Soudah Development, a subsidiary of the Public Investment Fund (PIF). An expert in risk frameworks, risk management strategy, Risk appetite, and Governance, Risk, and Compliance (GRC), he holds a PhD, an MBA, and several global certifications including CFI ESG, MIT, and TCFD. A Fellow of the Institute of Directors (IOD), he is also the author of three books and a published researcher, widely recognized as a thought leader in risk and sustainability.

Owned by: Institute of Directors, India

Disclaimer: The opinions expressed in the articles/ stories are the personal opinions of the author. IOD/ Editor is not responsible for the accuracy, completeness, suitability, or validity of any information in those articles. The information, facts or opinions expressed in the articles/ speeches do not reflect the views of IOD/ Editor and IOD/ Editor does not assume any responsibility or liability for the same.

Quick Links

Quick Links

Connect us

Connect us

Back to Home

Back to Home